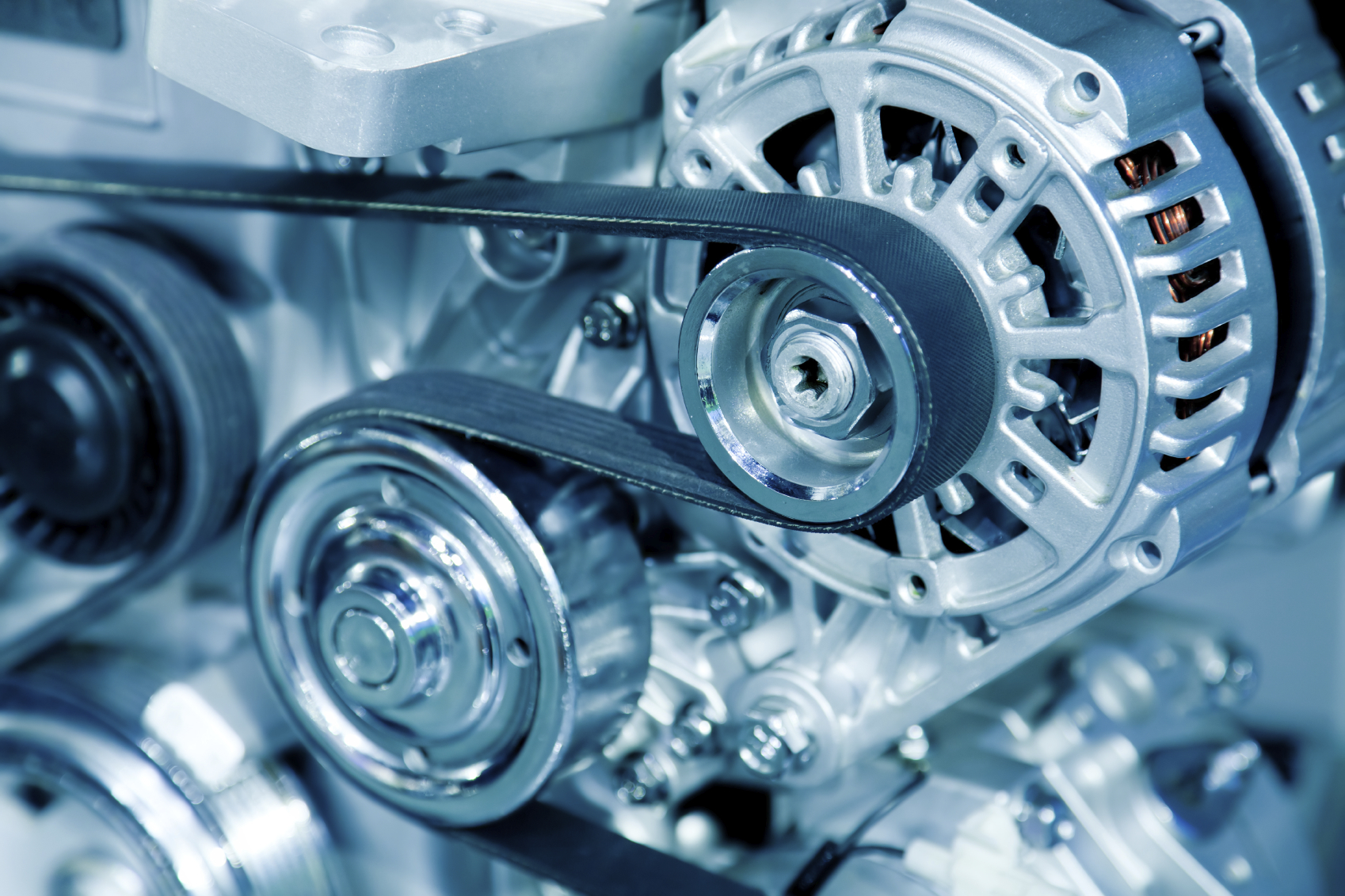

A private equity-backed $350M automotive manufacturing company suffering from production constraints was looking to augment production operations in North America by expanding into Mexico. The Challenge The client was interested in expanding production to Mexico to create a strategic cost advantage, but had limited experience in Mexican labor rates, laws, real estate practices, government incentives,… Read More

A $300M North American children’s toy and product manufacturer

A $250 million machined aerospace structures company with seven global production facilities serving both military and commercial aerospace markets had made multiple acquisitions each year for several years and had significant discrepancies in operational performance from factory to factory (7 total). Many of the acquisitions had been long time family run businesses that had limited operational best practice implementation or adaption. As a result, several of the facilities were operating at sub-optimal performance level. The holding company turned to TriVista, leveraging our expert team to identify manufacturing and inventory opportunities within two production facilities representing approximately $140 million in sales. A key deliverable was to determine why these two facilities, despite exceeding growth expectations on topline revenue, were lagging on margin, EBITDA and cash flow performance compared to the remaining five sites.

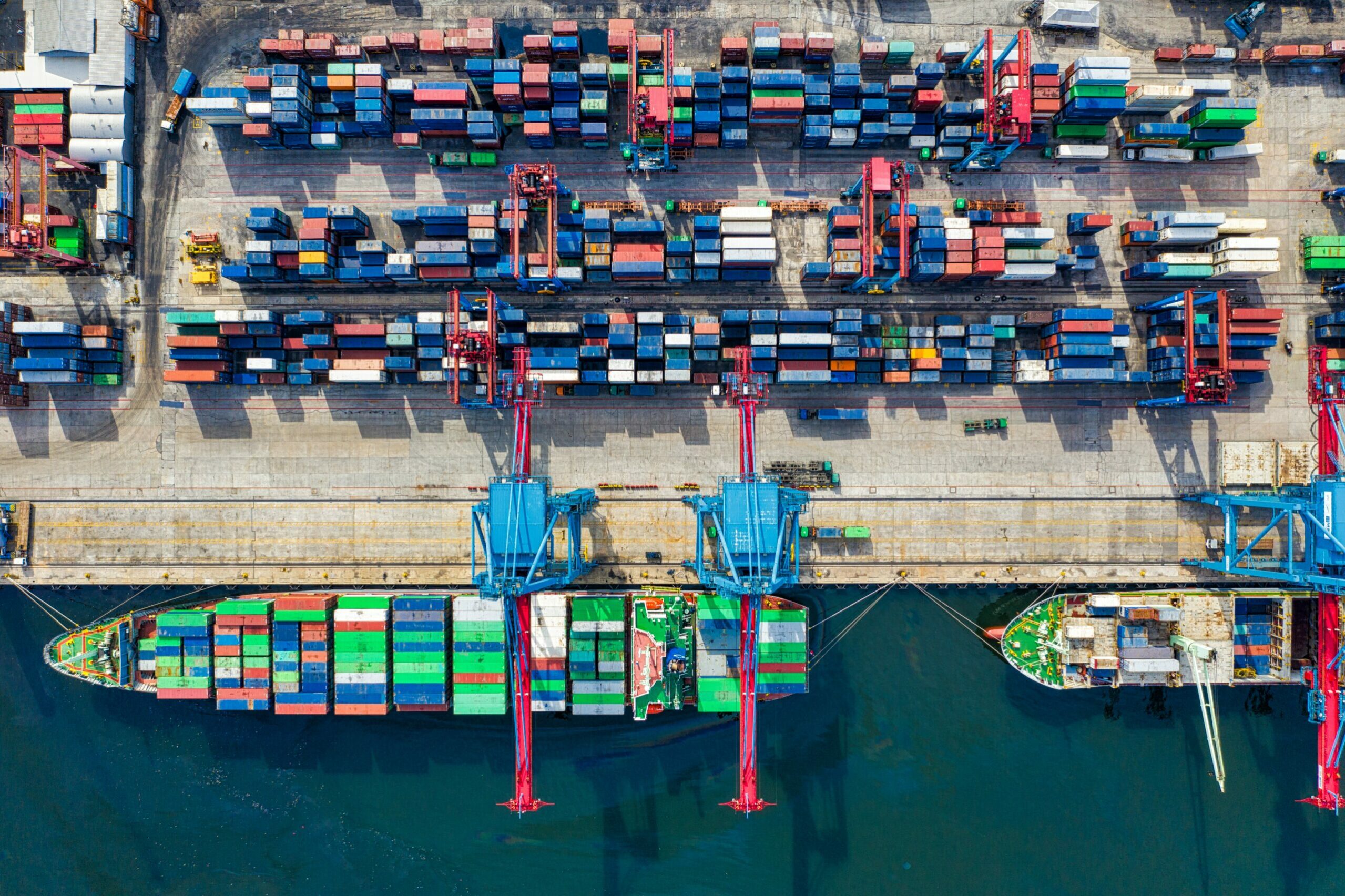

A private equity owned sporting goods manufacturer was experiencing declining margins and excess capacity at their China production facility. Smaller production volumes, poor inventory management and shrinking profits necessitated the closure of their full-scale production facility. TriVista was retained to facilitate and manage the shutdown and transfer the remaining inventory, supply chain and production back to the US headquarters. Multiple levels of negotiations were necessary to keep labor unions, government officials, and interested parties all satisfied during the closure.

A successful, international manufacturing company was struggling with its existing China facility, comprised of multiple small warehouses and poor process flow. With growing domestic sales in China, the client decided to make a long-term investment in relocating to a new facility with improved production flow and room for expected growth. Recognizing that our client faced multiple deadlines with their customers and landlords, TriVista was committed to meet our client’s needs while adapting the project schedule to best fit the changing order flow. Communication was essential, requiring input from both American and Chinese stakeholders in multiple languages to conduct the feasibility study, select the new facility, make necessary improvements and manage the relocation.

TriVista dramatically improved customer service by implementing a robust Sales, Inventory, and Operations Planning (SIOP) Process that decreased stock-outs by 50% without additional inventory. The Challenge TriVista’s client was facing increasing backorders and rapidly declining customer satisfaction. Our team was tasked with developing an improved supplier and inventory management system which would eliminate stock outs… Read More

Leveraging TriVista’s Lean Six Sigma and operations experience, the client was able to increase On-time deliveries, decrease outsourcing, and stabilize production scheduling at its facility in China. The Challenge A $25 million, privately owned, U.S.-based cosmetics packaging manufacturer was facing production management issues at one of its manufacturing facilities in China. While aggressive marketing and successful product… Read More

The Challenge A $700 Million Private Equity fund was interested in acquiring a $100 Million industrial components manufacturer with a presence in the U.S. and China. Given their limited experience in cross-border deals, the firm retained TriVista to conduct a detailed Operational Due Diligence in both countries. The Approach TriVista mobilized project teams in China… Read More

STRENGTHENING THE SUPPLIER BASE, STREAMLINING LOGISTICS NETWORK, AND EMPOWERING THE LEADERSHIP TEAM The Challenge A $400M in sales revenue, multi-division industrial products manufacturer was experiencing major issues in its Asia and China supply chain. Poor On-Time-Delivery and high logistics costs were forcing the company to absorb substantial price increases, while struggling with poor quality shipments…. Read More