Transaction Advisory Services

TriVista delivers transaction advisory services backed by deep operating expertise, sector-specific experience, and global reach. We help clients navigate high-stakes M&A activity with precision through due diligence, uncovering value, and mitigating risk.

Our team empowers acquirers and investors to make confident decisions in today’s always-moving deal environment through integrated transaction advisory consulting services that span operations, regulatory compliance, and technology.

Our Comprehensive Transaction Advisory Capabilities

TriVista’s transaction advisory services address the full complexity of modern deals. Our consulting team brings operational, regulatory, and technical specialists together to help clients analyze obstacles, validate investment theses, and identify growth opportunities.

From operations to ESG compliance, our transaction services advisory approach ensures nothing is overlooked during the diligence process.

Quality of Operations Due Diligence (Q of O™)

Our proprietary Quality of Operations (Q of O™) methodology offers a structured and accelerated approach to operational due diligence.

This proven process benchmarks company performance, quantifies improvement potential, and outlines clear, actionable plans for driving results.

As a core part of our transaction advisory services, Q of O™ helps buyers validate operational value and uncover upside before the deal closes.

Technology and Cybersecurity Due Diligence

We evaluate how well a target company’s technology infrastructure supports its business model and future growth.

Our transaction advisory consulting services include a detailed assessment of cybersecurity, software applications, and IT due diligence. This information helps investors understand cybersecurity, required investments, and overall scalability.

When you work with TriVista’s services, you guarantee alignment with your post-close integration and digital transformation goals.

ESG, Regulatory, and Food Safety

TriVista’s ESG due diligence evaluates environmental, social, and governance practices using proprietary benchmarks and cross-functional expertise.

We also offer regulatory and food safety due diligence for clients in highly regulated industries – highlighting compliance gaps, liabilities, and operational risks. These transaction advisory services enable buyers like you to protect long-term value and meet evolving stakeholder expectations.

Value Creation Through Integration and Exit Planning

Capturing deal value doesn’t end at close. TriVista’s transaction advisory services extend beyond diligence to facilitate post-transaction execution.

Our consulting teams work with buyers and sellers to build integration strategies and exit plans that protect operations, accelerate performance gains, and enhance enterprise value. Whether managing a merger, spin-off, or divestiture, we ensure your strategic vision translates into measurable results.

Post-Merger Integration Consulting Services

A successful acquisition depends on seamless post-close execution. TriVista partners with clients to develop detailed post-merger integration plans to preserve business continuity, align leadership, and achieve operational improvements across functions.

Our transaction advisory consulting services prioritize cultural alignment, functional coordination, and performance tracking to prevent value erosion and drive sustained momentum across the organization.

Carve-Out and Divestiture Planning Guidance

Divesting a business unit or executing a carve-out requires precision and foresight. We empower clients to navigate these complex transactions by assessing operational separation requirements, identifying transitional road bumps, and building standalone cost structures.

Sell-Side Transaction Advisory Consulting Services

TriVista’s sell-side transaction advisory consulting services position business owners and investment teams to maximize value before going to market.

We provide a comprehensive review of operational performance and improvement opportunities, delivering the validation that today’s buyers demand. From refining the equity story to preparing data rooms, our transaction advisory services offer a smoother process, faster timeline, and stronger outcome.

Whether preparing for a complete exit or a partial divestment, we help sellers position their businesses to attract serious buyers and confidently defend their value.

Exit Readiness and Performance Assessments

Before entering a sales process, understanding how potential buyers perceive your business is crucial.

TriVista’s transaction advisory services include in-depth exit readiness assessments that examine operational efficiency, scalability, and EBITDA levers.

Our strategies allow sellers to identify performance gaps and highlight value creation opportunities to ensure the business is positioned to command top-tier interest and competitive bids.

Third-Party Sell-Side Validation and Benchmarking

Plain and simple, buyers want transparency. Our sell-side transaction advisory consulting services deliver third-party operational and technical validation to reinforce your company’s investment narrative.

We benchmark your business against industry standards and communicate strengths clearly to reduce buyer skepticism and limit diligence-related surprises. The result? A smoother process, fewer delays, and higher deal confidence from day one.

Real Results from Transaction Advisory Services

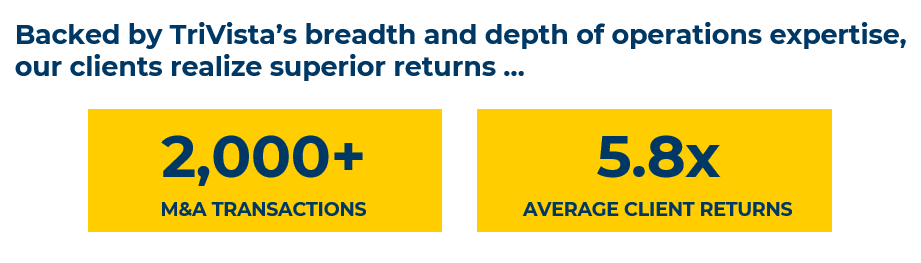

TriVista’s transaction advisory consulting services are trusted by leading private equity firms and corporate buyers across industries.

Case Study #1: ESG and Operational Due Diligence for a Seasonings Manufacturer

A private equity client considering the acquisition of a seasonings manufacturer operating in the US and Mexico partnered with TriVista for thorough due diligence. Our team conducted an enterprise-wide operational assessment, reviewed supply chain processes, and evaluated ESG practices.

As a result, we curated recommendations for supply chain diversification, a five-year ESG roadmap, and a six-month post-close food safety action plan. This holistic approach gave the client actionable insights to lead their investment decision.

Case Study #2: Post-Merger Integration for a Medical Equipment Manufacturer

Following the acquisition of a large competitor, a $150 million medical equipment company sought TriVista’s expertise for help with integration.

We performed a detailed feasibility analysis, including cost-benefit assessments and risk mitigation planning. Our team consolidated manufacturing and supply chains, saving $2.7 million in EBITDA. The project was delivered on time and within budget, demonstrating TriVista’s capability to facilitate successful post-merger integrations.

Explore more of our recent case studies to see how our expertise translates into measurable value in real-world deals.

Partner with a Proven Leader in Transaction Advisory Consulting Services

Whether preparing for a sale, pursuing an acquisition, or navigating post-close integration, TriVista offers the transaction advisory consulting services you need to move forward stress-free.

Contact us today to learn how our team can support your next strategic transaction.

Transaction Advisory Consulting Services FAQs

Learn more about TriVista’s transaction advisory consulting services and how else they benefit your business through our frequently asked questions.

What do transaction advisory services include?

Transaction advisory services typically cover operational, financial, regulatory, and technology reviews that guide mergers, acquisitions, divestitures, and exits.

How do TriVista’s transaction advisory consulting services differ from traditional financial diligence?

Unlike firms that focus solely on financials, TriVista’s mid-market transaction advisory consulting services go deeper. We analyze operations, ESG factors, technology infrastructure, and compliance risk. This in-depth view helps clients avoid hidden pitfalls and uncover performance opportunities.

When should I engage a transaction advisory team?

The earlier, the better! Engaging a transaction advisory services provider at the start of a deal allows for thorough preparation, informed negotiation, and faster execution.

Can sell-side transaction advisory services increase valuation?

Yes! Sell-side transaction advisory services uncover and document value drivers, strengthen operational credibility, and reduce perceived buyer risk. This preparation improves buyer confidence and often leads to stronger offers and smoother negotiations.

Our record speaks for itself. Within our focused industries, we support hundreds of transactions a year, working with leading private equity firms and corporate acquirers. We offer a unique, fully integrated due diligence and merger integration approach that supports buyouts, bolt-ons, carve-outs and corporate divestitures.