The Challenge A large racking manufacturer required a current state production roadmap and longer-term facility strategy to meet a significant growth opportunity. The company had multiple facilities spread across a medium sized market creating significant transportation and labors costs while creating production bottlenecks. The leadership team needed a thought partner to assist in understanding the… Read More

The Challenge Over a 3-year span our client expanded their operating footprint with the acquisition of 5 business with little integration. The rapid growth caused conflicting messaging across the enterprise and a siloed approach to core business functions including Sales, Product Development, Pricing, Engineering, Supply Chain, Scheduling and Manufacturing. The lack of synergy and adoption… Read More

An aerospace and defense company. The Challenge Our client, an aerospace and defense company, engaged TriVista to review the inventory control and management processes at their manufacturing facility. Inventory accuracy was reported between 10-20% after the previous 2 audits resulting in widespread material shortages. Planning and production teams were impacted daily by inaccurate inventories and… Read More

A label and packaging printing company. The Challenge TriVista was retained by a private equity firm that invested in a label and packaging business. The business had recently merged with a competitor, and our team was tasked with measuring and improving the Overall Equipment Effectiveness (OEE) of their flexographic printing and rewind departments. Our Approach… Read More

A $58M private equity-backed manufacturer and distributor of surimi-based seafood products. The Challenge After acquiring a manufacturer and distributor of seafood products, a private equity firm wanted to identify labor productivity improvements at a west coast facility. As a secondary priority, the firm wanted to identify other barriers to growth. Through the initial assessment, we… Read More

Challenge A leading global provider of aerospace products faced decreasing inventory turns, high excess and obsolete inventory, and poor service levels. Key business issues described by management included: Forecasts of profit were regularly inaccurate Inventory turns were trending unfavorably High employee turnover While all these symptoms pointed to SIOP, there were several competing root cause… Read More

A $150M private equity backed building products company

A $250 million machined aerospace structures company with seven global production facilities serving both military and commercial aerospace markets had made multiple acquisitions each year for several years and had significant discrepancies in operational performance from factory to factory (7 total). Many of the acquisitions had been long time family run businesses that had limited operational best practice implementation or adaption. As a result, several of the facilities were operating at sub-optimal performance level. The holding company turned to TriVista, leveraging our expert team to identify manufacturing and inventory opportunities within two production facilities representing approximately $140 million in sales. A key deliverable was to determine why these two facilities, despite exceeding growth expectations on topline revenue, were lagging on margin, EBITDA and cash flow performance compared to the remaining five sites.

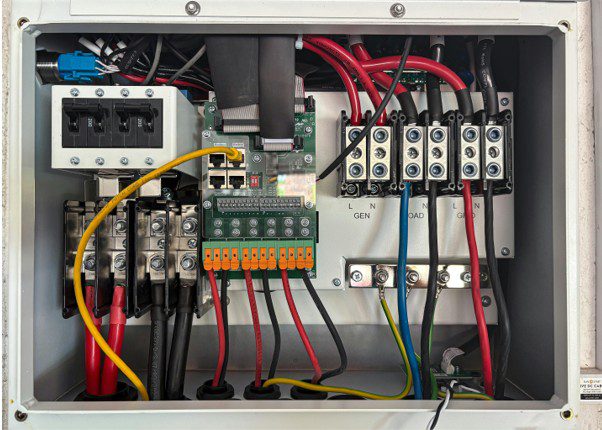

TriVista led efforts to drive process improvement, expand capacity and reduce inventory at a leading industrial equipment manufacturer. The Challenge TriVista’s client was a private equity owned $65 million manufacturer of industrial equipment. The company was trying to explore ways to increase capacity without adding additional roofline – max capacity was reached at their existing facility… Read More

Orchestrating Process Improvement in an Automotive Component Factory Company Confidential is a privately held $100 million manufacturer of specialty advanced technology heat exchange devices for the automotive, truck, and mobile equipment market. Company Confidential serves both commercial and military markets, with market segments ranging from general passenger vehicles, light duty trucks, heavy equipment, personnel transport,… Read More

Leveraging TriVista’s Lean Six Sigma expertise, the client was able to generate $2 million in EBITDA and reduce working capital by $6 million. The Challenge A $65 million consumer audio electronics manufacturer specializing in high end luxury audio components was facing decreasing sales and declining margins. Although their products are sold through the largest electronics… Read More

TriVista identified over $1.0 million of EBITDA savings for a leading printing and packaging company. The Challenge A private equity backed custom printing and plastic packaging company was facing challenges attributed to a series of recent acquisitions, along with a sub-optimized inventory management and forecasting process. Despite a dramatic increase in sales over the past… Read More

Leveraging TriVista’s Lean & Process Improvement Expertise, the client was able to generate $500,000 dollars in savings. The Challenge The largest provider of fresh deli solutions, TriVista’s client makes fresh salsa, dips, and hummus for consumers sold through major retail chains. Their product can be seen on grocery store aisles across the country and they… Read More

Leveraging TriVista’s Lean Six Sigma and operations experience, the client was able to increase On-time deliveries, decrease outsourcing, and stabilize production scheduling at its facility in China. The Challenge A $25 million, privately owned, U.S.-based cosmetics packaging manufacturer was facing production management issues at one of its manufacturing facilities in China. While aggressive marketing and successful product… Read More

ACCELERATING ORGANIC GROWTH VIA LEAN NEW PRODUCT DEVELOPMENT EXECUTIVE OVERVIEW: The Problem: One company with five major brands and no strong history of cooperation across divisions was falling behind in developing innovative new products. The Project: Two of TriVista’s top new-product development experts guided cross-functional teams to remake the way Maxcess listened to customers, evaluated new ideas, and… Read More

The Challenge A Private Equity backed $100M custom printing and packaging company serving the Consumer-Packaged Goods market sought assistance from an operational consulting firm to assess operations and provide actionable plans to improve customer service and expand margins. Our Approach TriVista conducted a 3 week assessment, focused on: Sales & Operations Planning (S&OP) Inventory Management… Read More

The Challenge A private equity backed company sought to consolidate their multiple manufacturing and distribution locations into one centralized campus. They utilized TriVista’s support to provide analysis and planning for the potential footprint consolidation. Our Approach TriVista conducted site visits across the entire network Facility planning to determine site requirements and layout options Financial analysis… Read More

The Challenge A $150M medical equipment company, backed by a prominent private equity firm, recently acquired a large competitor and sought support to integrate the two businesses. TriVista was retained to provide expert consolidation/integration consulting support, advising the CEO and Board of Directors. Our Approach TriVista leveraged our extensive experience dealing with complex plant consolidation… Read More

The Challenge A $500M manufacturer of windows, doors, insulated glass products was seeking expert operations consulting expertise to assist them in transforming their production operations. The company sought to deploy Lean Six Sigma and other manufacturing best practices across 3 sites in North America. TriVista was retained to help jump start their lean journey. Our… Read More

The Challenge A private equity-backed manufacturer and supplier of automotive brake components sought to relocate several US production facilities to Mexico to combat rising labor costs and address their growing customer base in Central America. TriVista was retained to provide factory relocation and consolidation consulting expertise, helping the company conduct a detailed study to determine… Read More