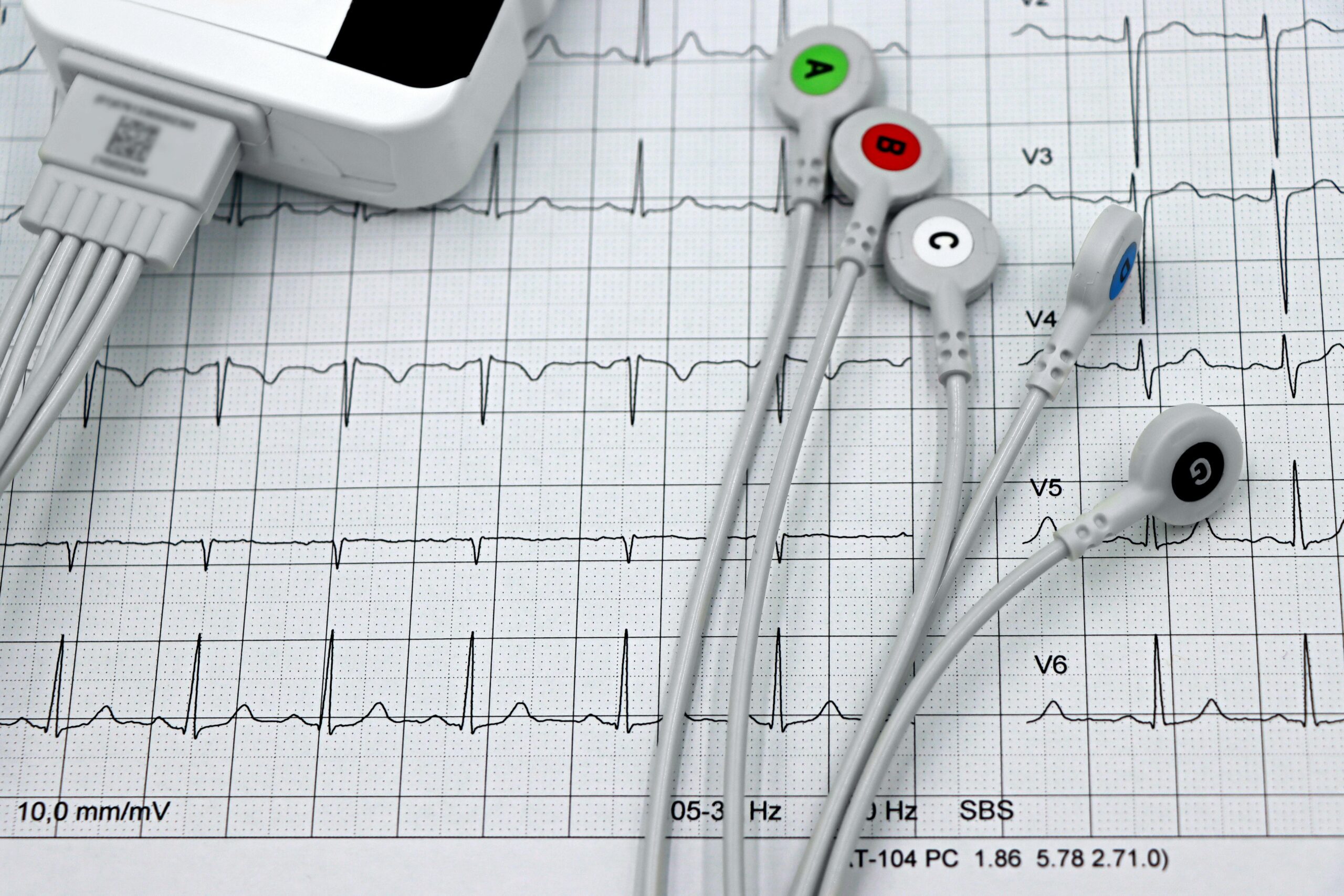

The Challenge A leading designer and manufacturer of medical equipment recently acquired a competitor and wanted to consolidate the manufacturing sites. They chose the acquired company’s site as the final location. The company needed help to move its existing production facility. The company brought TriVista on to help consolidate the manufacturing sites. Our Approach TriVista… Read More

The Challenge A client engaged TriVista to provide acquisition integration support relating to the integration of two leading medical device manufacturers. The scope of the integration included all SG&A, Operations, and IT including ERP harmonization. Our Approach Our team of experts broke down the engagement with the following approach: Conducted multiple site visits with key… Read More

Leading distributor of plumbing products acquired by an appliance repair parts distribution company. The Challenge TriVista was retained to provide acquisition integration support relating to the acquisition of a distributor of plumbing products. Client is a leading distributor of OEM branded residential appliance repair parts. Our Approach We performed functional assessments via site visits, detailed… Read More

THE CHALLENGE TriVista was engaged to assist with Day-1 planning and post-close development of combined company operating model including integration plans. Acquired company was based in Asia which offered both complimentary and supplementary products and services. OUR APPROACH TriVista supported the Integration in 2 phases: Phase 1: Pre-Close/Day 1 Integration strategy and approach, project structure… Read More

A $1B private equity owned automotive aftermarket re-manufacturer was seeking to acquire a $140M bolt-on.

A Private Equity-backed specialty coatings company was seeking to acquire a sizeable competitor with complementary adjacencies hired TriVIsta to conduct a pre-acquisition Quality of Operations® Due Diligence assessment to model the options, costs, savings and resources required to integrate the businesses, as well as develop a detailed integration plan

The Challenge A packaging company was in the process of acquiring a competitor. There was significant synergy opportunity across the combined 11 production sites. TriVista was brought on to complete a Quality of Operations™ Due Diligence Assessment, as well as complete a detailed synergy analysis that clearly calculated the practicality and upside associated with the… Read More

The Challenge A $150M medical equipment company, backed by a prominent private equity firm, recently acquired a large competitor and sought support to integrate the two businesses. TriVista was retained to provide expert consolidation/integration consulting support, advising the CEO and Board of Directors. Our Approach TriVista leveraged our extensive experience dealing with complex plant consolidation… Read More