The Challenge A large racking manufacturer required a current state production roadmap and longer-term facility strategy to meet a significant growth opportunity. The company had multiple facilities spread across a medium sized market creating significant transportation and labors costs while creating production bottlenecks. The leadership team needed a thought partner to assist in understanding the… Read More

The Challenge Over a 3-year span our client expanded their operating footprint with the acquisition of 5 business with little integration. The rapid growth caused conflicting messaging across the enterprise and a siloed approach to core business functions including Sales, Product Development, Pricing, Engineering, Supply Chain, Scheduling and Manufacturing. The lack of synergy and adoption… Read More

The Challenge A Fortune 1000 life sciences company engaged TriVista to support the carve out and sale of a >$1B division. After completing the transaction, the seller needed to execute pre-sale post-close plans to fulfill their obligations to the buyer. This included achieving 1-Day, 30-Day, and 90-Day transition milestones, maintaining stable operations under the Transitional… Read More

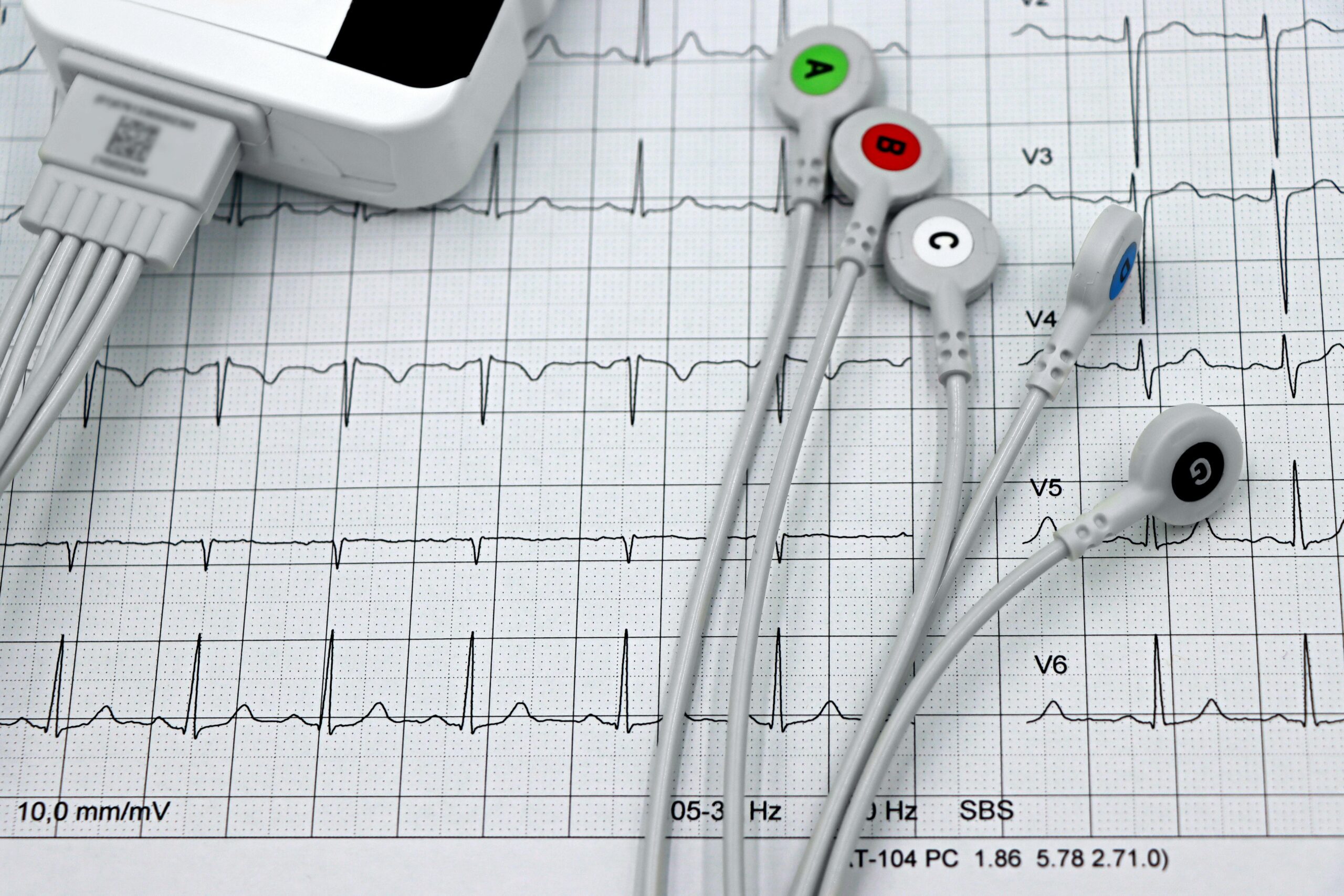

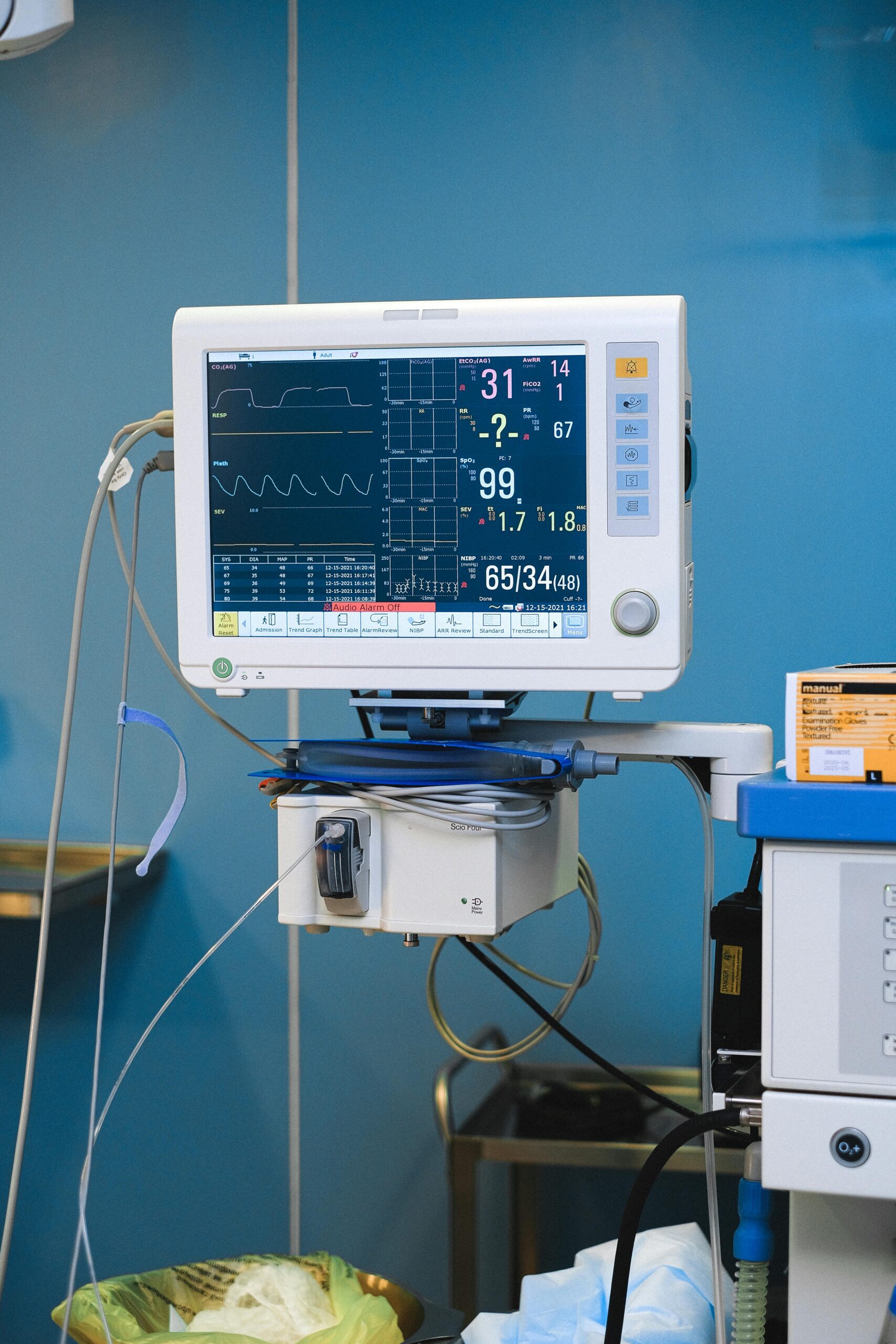

The Challenge A leading designer and manufacturer of medical equipment recently acquired a competitor and wanted to consolidate the manufacturing sites. They chose the acquired company’s site as the final location. The company needed help to move its existing production facility. The company brought TriVista on to help consolidate the manufacturing sites. Our Approach Analyzed… Read More

The Challenge A leading designer and manufacturer of medical equipment recently acquired a competitor and wanted to consolidate the manufacturing sites. They chose the acquired company’s site as the final location. The company needed help to move its existing production facility. The company brought TriVista on to help consolidate the manufacturing sites. Our Approach TriVista… Read More

The Challenge A client engaged TriVista to provide acquisition integration support relating to the integration of two leading medical device manufacturers. The scope of the integration included all SG&A, Operations, and IT including ERP harmonization. Our Approach Our team of experts broke down the engagement with the following approach: Conducted multiple site visits with key… Read More

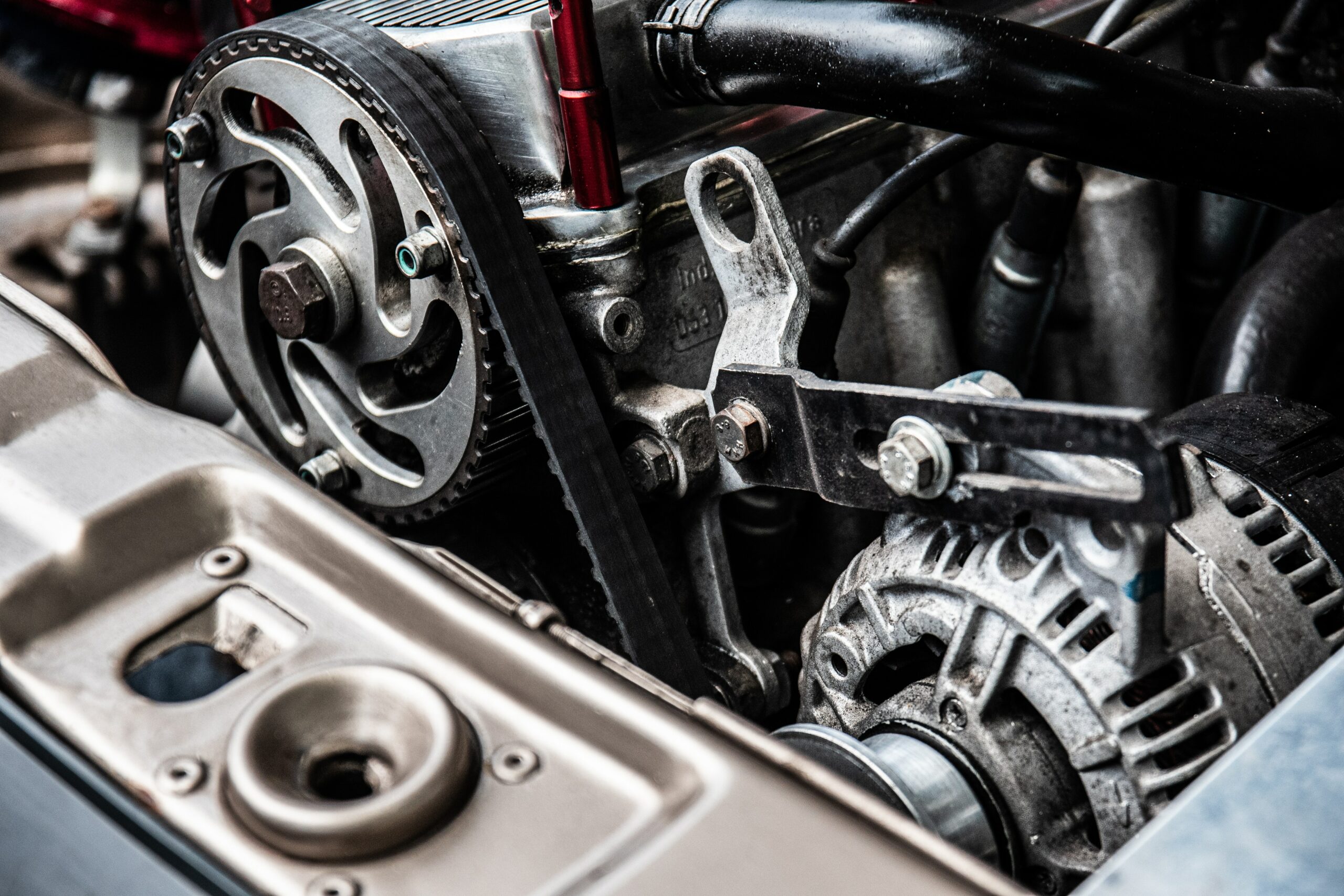

The Challenge Several clients across the automotive, lumber, and plastics industries were facing rising input costs without a clear understanding of cost drivers. Poor visibility into the cost structures of commodities, goods, and services contributed to their margin compression. These businesses sought an expert partner to uncover hidden cost-saving opportunities through an accurate benchmarking process…. Read More

Leading manufacturer of intelligent metering systems The Challenge A leading manufacturer of intelligent metering systems was looking to mitigate geopolitical and single-source risks in their supply chain. With 50% of components sourced from China and PCBAs*, metal parts, and batteries reliant on single sources, TriVista was tasked with identifying alternative suppliers to ensure high-quality continuity… Read More

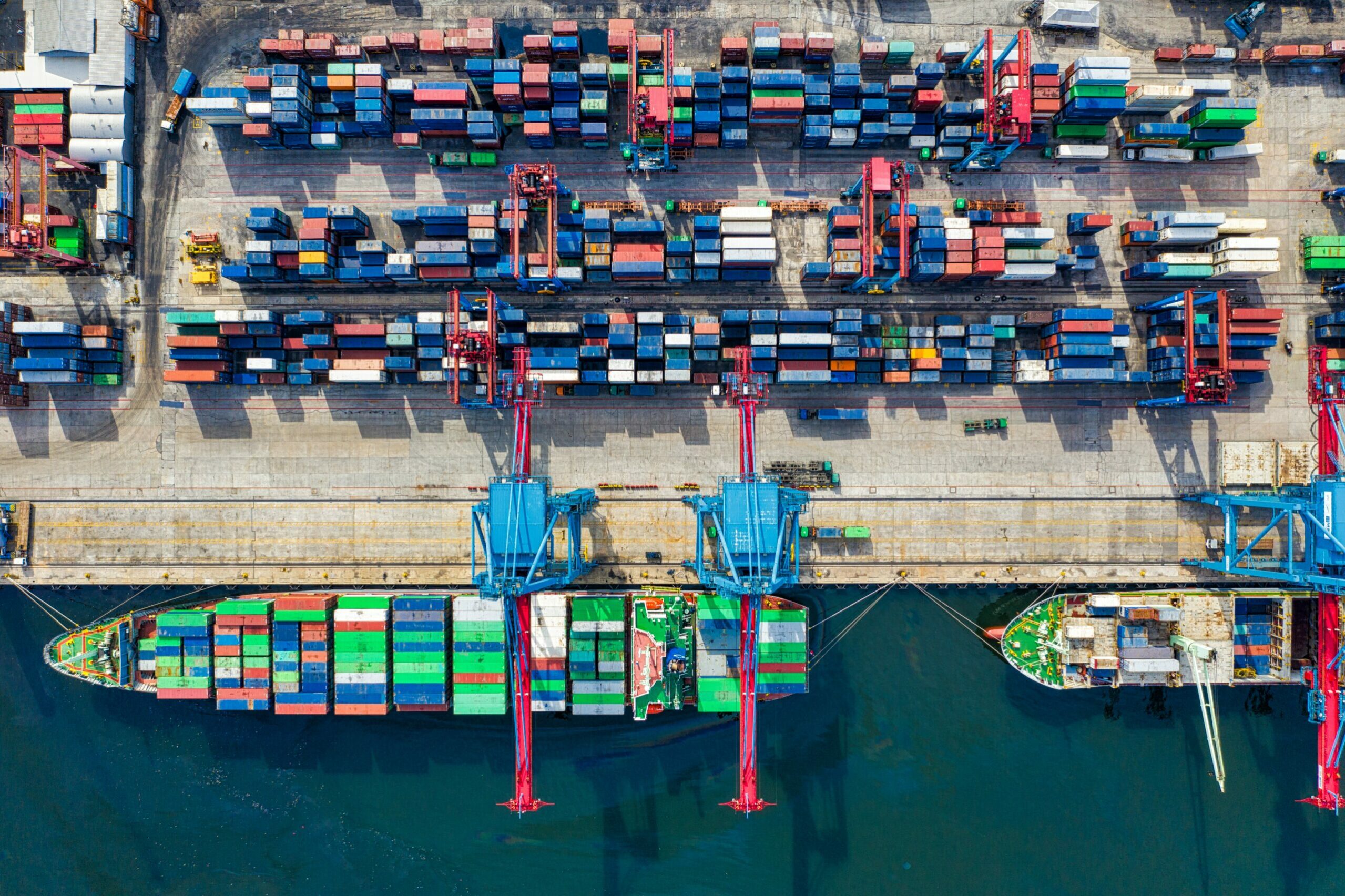

Manufacturer of liquid fill products serving global brands and retailers The Challenge A leading wet wipes manufacturer sourced most of its supply chain in the US but recent acquisitions increased sourcing from India and China. The client enlisted TriVista’s support to cut overall material costs by potentially shifting additional categories to low-cost countries (LCC). Our… Read More

A furniture manufacturer. The Challenge A furniture manufacturer hit maximum production capacity in their existing facility. With an estimated 70% increase in year-over-year revenue, the company recognized the need to expand its footprint to accommodate growth. Considering the possibility of opening a second facility, they sought TriVista’s expertise to explore options for increasing production output… Read More

A fast-growing producer and distributor of ethnic food. The Challenge TriVista was hired to conduct a Quality of Operations™, Food Safety, and IT Due Diligence assessment on a producer and distributor of dry packed food goods. Our Approach TriVista conducted a due diligence assessment of key business value streams and associated IT support systems with… Read More

An aerospace and defense company. The Challenge Our client, an aerospace and defense company, engaged TriVista to review the inventory control and management processes at their manufacturing facility. Inventory accuracy was reported between 10-20% after the previous 2 audits resulting in widespread material shortages. Planning and production teams were impacted daily by inaccurate inventories and… Read More

A packaging component manufacturer. The Challenge TriVista was engaged by a private equity firm to perform a Quality of Operations™ Due Diligence assessment on a packaging component manufacturer that was being considered for acquisition. The scope of the analysis included identifying potential acquisition synergies and developing integration strategies for the target company and the portfolio… Read More

A manufacturer of machinery and equipment. The Challenge A private equity firm was looking to acquire a leading manufacturer and importer of machinery and equipment. They brought in TriVista to conduct both an operations and IT due diligence to help identify operational and IT levers that would continue to expand EBITDA and/or reduce current operational… Read More

A label and packaging printing company. The Challenge TriVista was retained by a private equity firm that invested in a label and packaging business. The business had recently merged with a competitor, and our team was tasked with measuring and improving the Overall Equipment Effectiveness (OEE) of their flexographic printing and rewind departments. Our Approach… Read More

A car care products company. The Challenge A private equity-owned car care products company sought to enhance operational performance by focusing on SKU rationalization and inventory management. Rapid growth, driven by organic demand and expansion into new channels, posed challenges in servicing customer orders and optimizing working capital. TriVista was brought in help the business… Read More

A landscaping company. The Challenge TriVista was retained by private equity investors and the leadership team of a landscaping business to provide Quality of Operations™, Information Technology Due Diligence, and cost synergy analysis relating to the possible add-on acquisition of another landscaping company. Our Approach Through site visits with the target company, interviews with the… Read More

Leading distributor of plumbing products acquired by an appliance repair parts distribution company. The Challenge TriVista was retained to provide acquisition integration support relating to the acquisition of a distributor of plumbing products. Client is a leading distributor of OEM branded residential appliance repair parts. Our Approach We performed functional assessments via site visits, detailed… Read More

A seasonings manufacturer with sites in the U.S. and Mexico. The Challenge A private equity client was considering acquiring a food manufacturer of seasonings that use fresh ingredients. The target operates facilities in the U.S. and Mexico. The facilities have undergone recent changes in management and are experiencing market growth as well as implementing operational… Read More

A producer of food products that focus on healthy fats and plant-based proteins. The Challenge A private equity firm was evaluating the acquisition of producer of food products that focus on healthy fats and plant-based proteins. The firm brought us in to evaluate overall operations strategy, quality and food safety, co-manufacturer production operations, SIOP, and… Read More

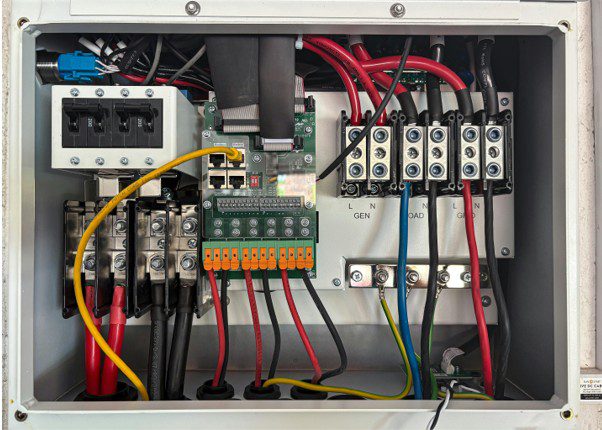

A private-equity backed manufacturer and distributor of industrial electrical components. The Challenge A U.S.-based manufacturer and distributor of electrical components was shipping from 3 warehouses, and all were at or near full capacity. With the company’s aggressive growth plans – both organic and acquisitive – they were looking to better understand their footprint and operations…. Read More

Inventory Analysis Identified $115M of Working Capital Improvement and a $22M Reduction of Inventory

$1B revenue business that manufacturers and supplies replacement parts for the automotive aftermarket. The Challenge A large manufacturer of car parts required significant working capital for acquisition growth and requested support to identify and develop a future inventory model to reduce working capital as well as identify root-cause drivers of current excess inventory. Our Approach… Read More

A $58M private equity-backed manufacturer and distributor of surimi-based seafood products. The Challenge After acquiring a manufacturer and distributor of seafood products, a private equity firm wanted to identify labor productivity improvements at a west coast facility. As a secondary priority, the firm wanted to identify other barriers to growth. Through the initial assessment, we… Read More

According to Statista, the average ERP selection process takes 17 weeks. The Challenge A multi-site, rapidly growing B2B and B2C services company was looking for support in modernizing outdated technologies and mitigating IT risk. Their current technology stack was missing key functionalities and they wanted to ensure a new solution was found quickly and would… Read More

According to Cybersecurity Ventures, more than 50% of cyberattacks are committed against small-to-mid-sized businesses. The Challenge During the due diligence process, a private equity firm discovered the target – a leader in the design and manufacture of packaging products and equipment for consumer and industrial applications – lacked cybersecurity insurance which was a requirement for… Read More

The Challenge TriVista was engaged by a private equity firm to conduct a Quality of Operations™ (QOO™) due diligence and technology rapid assessment on a leading automotive performance aftermarket company with revenues of $325M. The target company operates with 5 primary distribution centers throughout North America and 1 small manufacturing facility servicing customers in vehicle… Read More

The Challenge TriVista was hired by a private equity firm to conduct a Quality of Operations™ and Technology Due Diligence assessment on a leading professional services consulting firm. The target company is a platform investment opportunity that the private equity firm plans to support with the continued growth of the business through both organic and… Read More

THE CHALLENGE TriVista was engaged to assist with Day-1 planning and post-close development of combined company operating model including integration plans. Acquired company was based in Asia which offered both complimentary and supplementary products and services. OUR APPROACH TriVista supported the Integration in 2 phases: Phase 1: Pre-Close/Day 1 Integration strategy and approach, project structure… Read More

The Challenge A private equity backed, leading service provider who installs and repairs home / business security products retained TriVista to provide a Quality of Operations™ due diligence relating to the possible beach-head, add-on acquisition with multiple locations for its platform business. Our Approach Through a site visit of the target company, management calls, and… Read More

The Challenge The client – a $4B leading American grocery store operator, with 200+ stores – had a current distribution network consisting of several distribution centers across the region. Due to the relatively condensed network, there were many overlapping shipments and duplications of inventory. The client’s leadership believed there was significant opportunity to optimize both… Read More

The Challenge A private equity backed, global provider of mission critical hardware and plumbing components approached TriVista for assistance in creating a global sourcing strategy to combat recent increases in supply costs of Chinese goods, due largely to imposed tariffs, increased labor expenses, and tighter environmental regulations. The increased costs were passed on to customers… Read More

A rapidly growing $100M+ e-Commerce distributor with a large distribution network across multiple e-commerce platforms ran into capacity constraints due to lack of warehouse space and a large amount of slow-moving inventory, hindering their ability to meet expected growth targets The Challenge With over 7,000 SKUs and plans to bring on an additional 1,500+ SKUs… Read More

A private equity-backed $350M automotive manufacturing company suffering from production constraints was looking to augment production operations in North America by expanding into Mexico. The Challenge The client was interested in expanding production to Mexico to create a strategic cost advantage, but had limited experience in Mexican labor rates, laws, real estate practices, government incentives,… Read More

Challenge A leading global provider of aerospace products faced decreasing inventory turns, high excess and obsolete inventory, and poor service levels. Key business issues described by management included: Forecasts of profit were regularly inaccurate Inventory turns were trending unfavorably High employee turnover While all these symptoms pointed to SIOP, there were several competing root cause… Read More

The Challenge A leading, Private Equity-backed producer of plant-based meat substitutes opened a second facility to accommodate its rapid growth and needed new plant leadership. Our Approach TriVista Recruitment visited the new facility to gain a detailed and thorough understanding of operations and culture to help efficiently identify appropriate and qualified job candidates TriVista operational… Read More

The Challenge A Private Equity backed manufacturer of aircraft components needed a President with strong leadership skills and specific manufacturing knowledge to lead post-acquisition restructuring. Our Approach TriVista conducted a national search for candidate with specific machining experience, team leadership skills, and an intellectual capacity to drive growth strategy Candidates were vetted and assessed on… Read More

A private equity firm evaluating an investment in an $80M ready-to-assemble home furniture manufacturer

A $300M North American children’s toy and product manufacturer

A $150M private equity owned building products manufacturer.

A $150M private equity backed building products company

A $1B private equity owned automotive aftermarket re-manufacturer was seeking to acquire a $140M bolt-on.

A Private equity firm looking to acquire a $15M revenue medical device company retained TriVista to perform a Quality of Operations due diligence

A Private Equity-backed specialty coatings company was seeking to acquire a sizeable competitor with complementary adjacencies hired TriVIsta to conduct a pre-acquisition Quality of Operations® Due Diligence assessment to model the options, costs, savings and resources required to integrate the businesses, as well as develop a detailed integration plan

A Private Equity firm retained TriVista to conduct a pre-acquisition Quality of Operations® Due Diligence on a $57M manufacturer and supplier of specialty car care chemical products

A $250 million machined aerospace structures company with seven global production facilities serving both military and commercial aerospace markets had made multiple acquisitions each year for several years and had significant discrepancies in operational performance from factory to factory (7 total). Many of the acquisitions had been long time family run businesses that had limited operational best practice implementation or adaption. As a result, several of the facilities were operating at sub-optimal performance level. The holding company turned to TriVista, leveraging our expert team to identify manufacturing and inventory opportunities within two production facilities representing approximately $140 million in sales. A key deliverable was to determine why these two facilities, despite exceeding growth expectations on topline revenue, were lagging on margin, EBITDA and cash flow performance compared to the remaining five sites.

A $250 million machined aerospace structures company with seven global production facilities serving both military and commercial aerospace markets had made multiple acquisitions each year for several years and had significant discrepancies in operational performance from factory to factory (7 total). Many of the acquisitions had been long time family run businesses that had limited operational best practice implementation or adaption. As a result, several of the facilities were operating at sub-optimal performance level. The holding company turned to TriVista, leveraging our expert team to identify manufacturing and inventory opportunities within two production facilities representing approximately $140 million in sales. A key deliverable was to determine why these two facilities, despite exceeding growth expectations on topline revenue, were lagging on margin, EBITDA and cash flow performance compared to the remaining five sites.

A private equity owned sporting goods manufacturer was experiencing declining margins and excess capacity at their China production facility. Smaller production volumes, poor inventory management and shrinking profits necessitated the closure of their full-scale production facility. TriVista was retained to facilitate and manage the shutdown and transfer the remaining inventory, supply chain and production back to the US headquarters. Multiple levels of negotiations were necessary to keep labor unions, government officials, and interested parties all satisfied during the closure.

A successful, international manufacturing company was struggling with its existing China facility, comprised of multiple small warehouses and poor process flow. With growing domestic sales in China, the client decided to make a long-term investment in relocating to a new facility with improved production flow and room for expected growth. Recognizing that our client faced multiple deadlines with their customers and landlords, TriVista was committed to meet our client’s needs while adapting the project schedule to best fit the changing order flow. Communication was essential, requiring input from both American and Chinese stakeholders in multiple languages to conduct the feasibility study, select the new facility, make necessary improvements and manage the relocation.

TriVista guided a large automotive manufacturing company through the process of establishing a new facility, which included a multi-region feasibility study, comprehensive project design, and a strategic implementation plan.

TriVista led efforts to drive process improvement, expand capacity and reduce inventory at a leading industrial equipment manufacturer. The Challenge TriVista’s client was a private equity owned $65 million manufacturer of industrial equipment. The company was trying to explore ways to increase capacity without adding additional roofline – max capacity was reached at their existing facility… Read More

Orchestrating Process Improvement in an Automotive Component Factory Company Confidential is a privately held $100 million manufacturer of specialty advanced technology heat exchange devices for the automotive, truck, and mobile equipment market. Company Confidential serves both commercial and military markets, with market segments ranging from general passenger vehicles, light duty trucks, heavy equipment, personnel transport,… Read More

Leveraging TriVista’s Lean Six Sigma expertise, the client was able to generate $2 million in EBITDA and reduce working capital by $6 million. The Challenge A $65 million consumer audio electronics manufacturer specializing in high end luxury audio components was facing decreasing sales and declining margins. Although their products are sold through the largest electronics… Read More

TriVista identified over $1.0 million of EBITDA savings for a leading printing and packaging company. The Challenge A private equity backed custom printing and plastic packaging company was facing challenges attributed to a series of recent acquisitions, along with a sub-optimized inventory management and forecasting process. Despite a dramatic increase in sales over the past… Read More

Leveraging TriVista’s Lean & Process Improvement Expertise, the client was able to generate $500,000 dollars in savings. The Challenge The largest provider of fresh deli solutions, TriVista’s client makes fresh salsa, dips, and hummus for consumers sold through major retail chains. Their product can be seen on grocery store aisles across the country and they… Read More

TriVista dramatically improved customer service by implementing a robust Sales, Inventory, and Operations Planning (SIOP) Process that decreased stock-outs by 50% without additional inventory. The Challenge TriVista’s client was facing increasing backorders and rapidly declining customer satisfaction. Our team was tasked with developing an improved supplier and inventory management system which would eliminate stock outs… Read More

Leveraging TriVista’s Lean Six Sigma and operations experience, the client was able to increase On-time deliveries, decrease outsourcing, and stabilize production scheduling at its facility in China. The Challenge A $25 million, privately owned, U.S.-based cosmetics packaging manufacturer was facing production management issues at one of its manufacturing facilities in China. While aggressive marketing and successful product… Read More

The Challenge A $700 Million Private Equity fund was interested in acquiring a $100 Million industrial components manufacturer with a presence in the U.S. and China. Given their limited experience in cross-border deals, the firm retained TriVista to conduct a detailed Operational Due Diligence in both countries. The Approach TriVista mobilized project teams in China… Read More

STRENGTHENING THE SUPPLIER BASE, STREAMLINING LOGISTICS NETWORK, AND EMPOWERING THE LEADERSHIP TEAM The Challenge A $400M in sales revenue, multi-division industrial products manufacturer was experiencing major issues in its Asia and China supply chain. Poor On-Time-Delivery and high logistics costs were forcing the company to absorb substantial price increases, while struggling with poor quality shipments…. Read More

A fashion jewelry leader aligns their supply chain to keep up with rapid sales growth. TriVista’s Diagnostic Process uncovered $10M in EBITDA savings and identified $12M in cash flow improvements. The Challenge A private equity backed retailer of women’s fashion jewelry and accessories was on track to double sales to $1B over the next 3… Read More

ACCELERATING ORGANIC GROWTH VIA LEAN NEW PRODUCT DEVELOPMENT EXECUTIVE OVERVIEW: The Problem: One company with five major brands and no strong history of cooperation across divisions was falling behind in developing innovative new products. The Project: Two of TriVista’s top new-product development experts guided cross-functional teams to remake the way Maxcess listened to customers, evaluated new ideas, and… Read More