A $250 million machined aerospace structures company with seven global production facilities serving both military and commercial aerospace markets had made multiple acquisitions each year for several years and had significant discrepancies in operational performance from factory to factory (7 total). Many of the acquisitions had been long time family run businesses that had limited operational best practice implementation or adaption. As a result, several of the facilities were operating at sub-optimal performance level. The holding company turned to TriVista, leveraging our expert team to identify manufacturing and inventory opportunities within two production facilities representing approximately $140 million in sales. A key deliverable was to determine why these two facilities, despite exceeding growth expectations on topline revenue, were lagging on margin, EBITDA and cash flow performance compared to the remaining five sites.

A successful, international manufacturing company was struggling with its existing China facility, comprised of multiple small warehouses and poor process flow. With growing domestic sales in China, the client decided to make a long-term investment in relocating to a new facility with improved production flow and room for expected growth. Recognizing that our client faced multiple deadlines with their customers and landlords, TriVista was committed to meet our client’s needs while adapting the project schedule to best fit the changing order flow. Communication was essential, requiring input from both American and Chinese stakeholders in multiple languages to conduct the feasibility study, select the new facility, make necessary improvements and manage the relocation.

TriVista guided a large automotive manufacturing company through the process of establishing a new facility, which included a multi-region feasibility study, comprehensive project design, and a strategic implementation plan.

TriVista led efforts to drive process improvement, expand capacity and reduce inventory at a leading industrial equipment manufacturer. The Challenge TriVista’s client was a private equity owned $65 million manufacturer of industrial equipment. The company was trying to explore ways to increase capacity without adding additional roofline – max capacity was reached at their existing facility… Read More

The Challenge A $700 Million Private Equity fund was interested in acquiring a $100 Million industrial components manufacturer with a presence in the U.S. and China. Given their limited experience in cross-border deals, the firm retained TriVista to conduct a detailed Operational Due Diligence in both countries. The Approach TriVista mobilized project teams in China… Read More

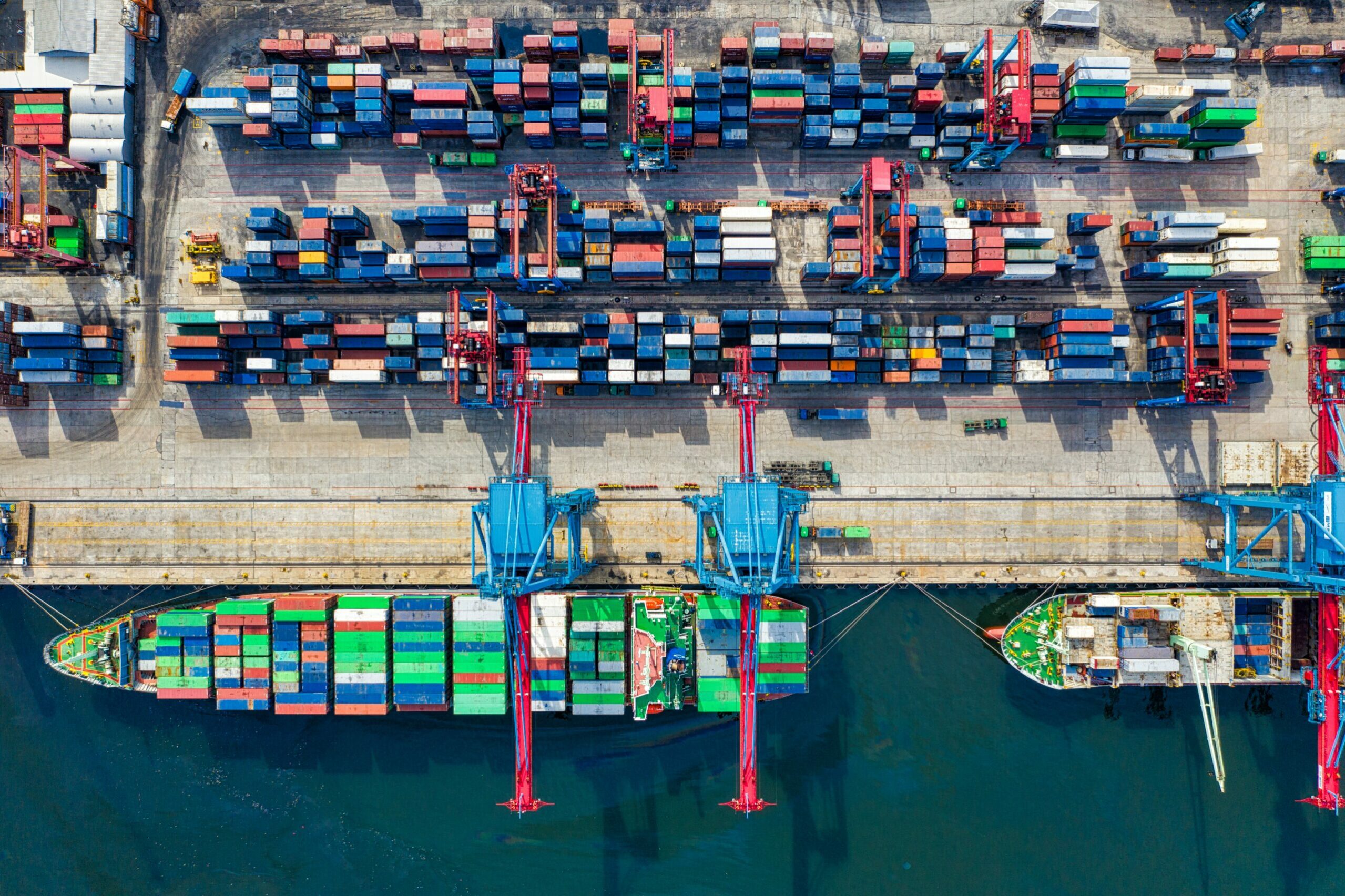

STRENGTHENING THE SUPPLIER BASE, STREAMLINING LOGISTICS NETWORK, AND EMPOWERING THE LEADERSHIP TEAM The Challenge A $400M in sales revenue, multi-division industrial products manufacturer was experiencing major issues in its Asia and China supply chain. Poor On-Time-Delivery and high logistics costs were forcing the company to absorb substantial price increases, while struggling with poor quality shipments…. Read More

ACCELERATING ORGANIC GROWTH VIA LEAN NEW PRODUCT DEVELOPMENT EXECUTIVE OVERVIEW: The Problem: One company with five major brands and no strong history of cooperation across divisions was falling behind in developing innovative new products. The Project: Two of TriVista’s top new-product development experts guided cross-functional teams to remake the way Maxcess listened to customers, evaluated new ideas, and… Read More

The Challenge: A $1B Private Equity fund was interested in acquiring a $300M manufacturer of cosmetic displays and retained the services of TriVista to conduct a standard Quality of Operations™ Due Diligence. Our Approach To thoroughly understand the target company’s business and operations, TriVista engaged in the following activities: Conducted an operational & capacity review… Read More

The Challenge A $120M food processing and conveyance equipment manufacturer engaged TriVista to conduct a sell-side Quality of Operations™ Due Diligence assessment with a focus on the company’s global operations Our Approach In addition to assessing the company’s product development processes, the TriVista team reviewed human capital requirements, manufacturing efficiencies, inventory management and footprint requirements…. Read More

The Challenge A $1B Private Equity Group was considering the possible divestiture of a $200M converting equipment manufacturer. The private equity firm hired TriVista to conduct a sell-side Quality of Operations™ Due Diligence with a focus on evaluating and opining on current operational processes and protocols, assessment of identified continuous improvement initiatives, and identification of… Read More