The Challenge A large racking manufacturer required a current state production roadmap and longer-term facility strategy to meet a significant growth opportunity. The company had multiple facilities spread across a medium sized market creating significant transportation and labors costs while creating production bottlenecks. The leadership team needed a thought partner to assist in understanding the… Read More

The Challenge Over a 3-year span our client expanded their operating footprint with the acquisition of 5 business with little integration. The rapid growth caused conflicting messaging across the enterprise and a siloed approach to core business functions including Sales, Product Development, Pricing, Engineering, Supply Chain, Scheduling and Manufacturing. The lack of synergy and adoption… Read More

A producer of food products that focus on healthy fats and plant-based proteins. The Challenge A private equity firm was evaluating the acquisition of producer of food products that focus on healthy fats and plant-based proteins. The firm brought us in to evaluate overall operations strategy, quality and food safety, co-manufacturer production operations, SIOP, and… Read More

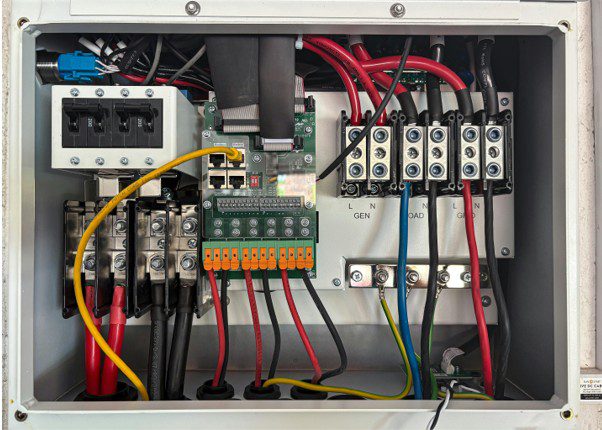

A private-equity backed manufacturer and distributor of industrial electrical components. The Challenge A U.S.-based manufacturer and distributor of electrical components was shipping from 3 warehouses, and all were at or near full capacity. With the company’s aggressive growth plans – both organic and acquisitive – they were looking to better understand their footprint and operations…. Read More

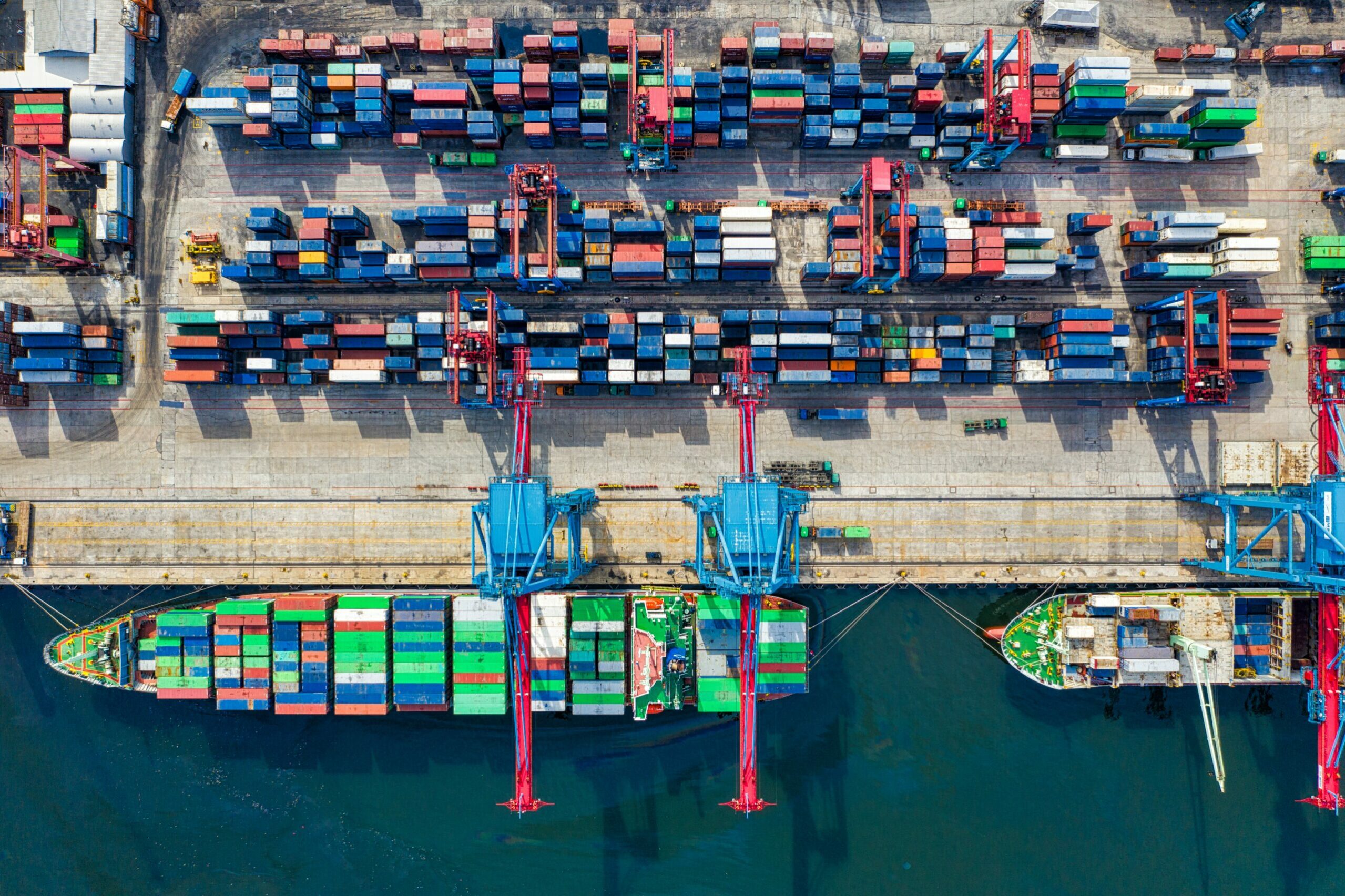

The Challenge A private equity backed, global provider of mission critical hardware and plumbing components approached TriVista for assistance in creating a global sourcing strategy to combat recent increases in supply costs of Chinese goods, due largely to imposed tariffs, increased labor expenses, and tighter environmental regulations. The increased costs were passed on to customers… Read More

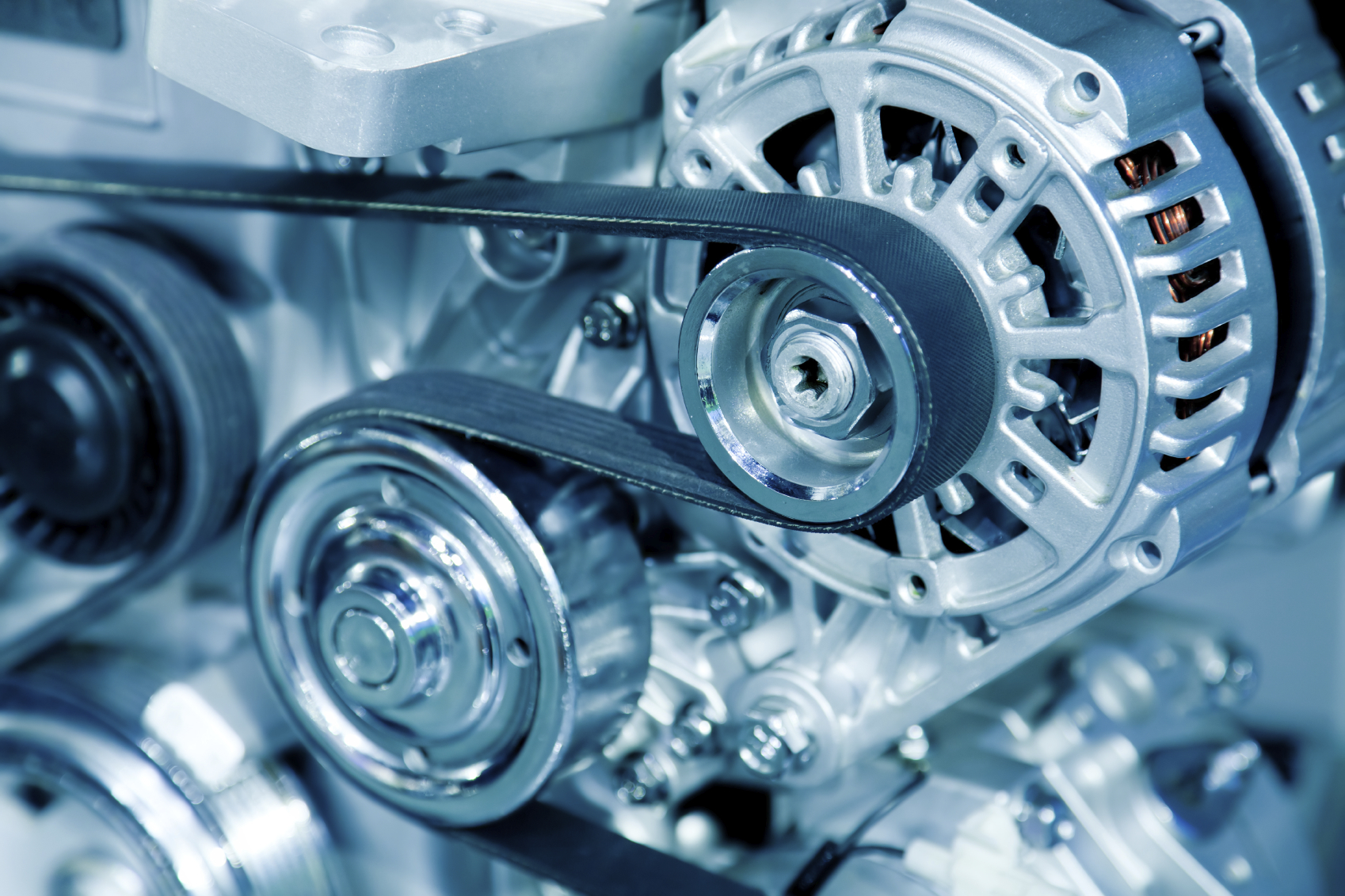

A private equity-backed $350M automotive manufacturing company suffering from production constraints was looking to augment production operations in North America by expanding into Mexico. The Challenge The client was interested in expanding production to Mexico to create a strategic cost advantage, but had limited experience in Mexican labor rates, laws, real estate practices, government incentives,… Read More

Challenge A leading global provider of aerospace products faced decreasing inventory turns, high excess and obsolete inventory, and poor service levels. Key business issues described by management included: Forecasts of profit were regularly inaccurate Inventory turns were trending unfavorably High employee turnover While all these symptoms pointed to SIOP, there were several competing root cause… Read More

The Challenge A Private Equity backed manufacturer of aircraft components needed a President with strong leadership skills and specific manufacturing knowledge to lead post-acquisition restructuring. Our Approach TriVista conducted a national search for candidate with specific machining experience, team leadership skills, and an intellectual capacity to drive growth strategy Candidates were vetted and assessed on… Read More

A private equity firm evaluating an investment in an $80M ready-to-assemble home furniture manufacturer

A $150M private equity owned building products manufacturer.

A $150M private equity backed building products company

A $1B private equity owned automotive aftermarket re-manufacturer was seeking to acquire a $140M bolt-on.

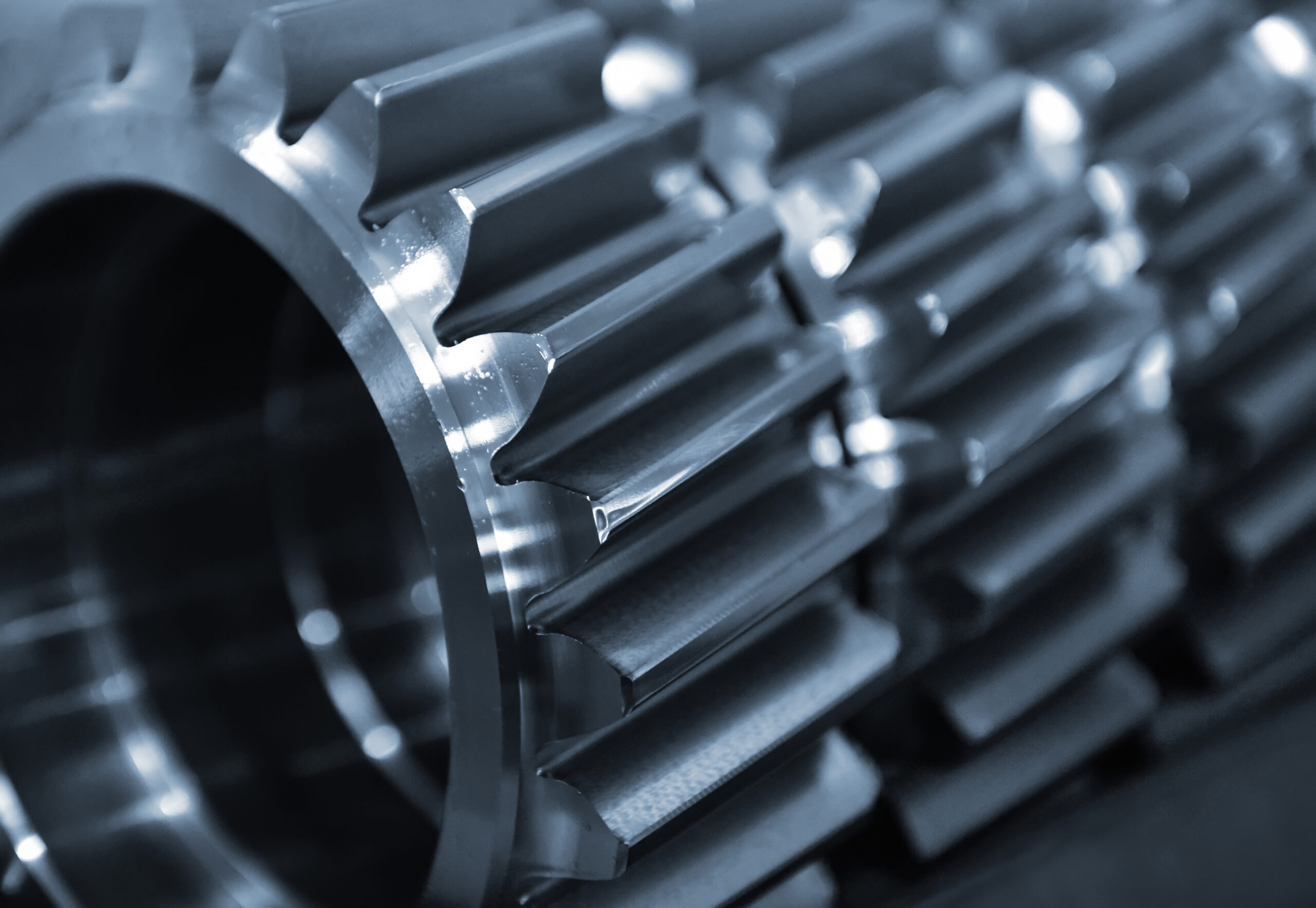

A $250 million machined aerospace structures company with seven global production facilities serving both military and commercial aerospace markets had made multiple acquisitions each year for several years and had significant discrepancies in operational performance from factory to factory (7 total). Many of the acquisitions had been long time family run businesses that had limited operational best practice implementation or adaption. As a result, several of the facilities were operating at sub-optimal performance level. The holding company turned to TriVista, leveraging our expert team to identify manufacturing and inventory opportunities within two production facilities representing approximately $140 million in sales. A key deliverable was to determine why these two facilities, despite exceeding growth expectations on topline revenue, were lagging on margin, EBITDA and cash flow performance compared to the remaining five sites.

A successful, international manufacturing company was struggling with its existing China facility, comprised of multiple small warehouses and poor process flow. With growing domestic sales in China, the client decided to make a long-term investment in relocating to a new facility with improved production flow and room for expected growth. Recognizing that our client faced multiple deadlines with their customers and landlords, TriVista was committed to meet our client’s needs while adapting the project schedule to best fit the changing order flow. Communication was essential, requiring input from both American and Chinese stakeholders in multiple languages to conduct the feasibility study, select the new facility, make necessary improvements and manage the relocation.

TriVista guided a large automotive manufacturing company through the process of establishing a new facility, which included a multi-region feasibility study, comprehensive project design, and a strategic implementation plan.

TriVista led efforts to drive process improvement, expand capacity and reduce inventory at a leading industrial equipment manufacturer. The Challenge TriVista’s client was a private equity owned $65 million manufacturer of industrial equipment. The company was trying to explore ways to increase capacity without adding additional roofline – max capacity was reached at their existing facility… Read More

The Challenge A $700 Million Private Equity fund was interested in acquiring a $100 Million industrial components manufacturer with a presence in the U.S. and China. Given their limited experience in cross-border deals, the firm retained TriVista to conduct a detailed Operational Due Diligence in both countries. The Approach TriVista mobilized project teams in China… Read More

STRENGTHENING THE SUPPLIER BASE, STREAMLINING LOGISTICS NETWORK, AND EMPOWERING THE LEADERSHIP TEAM The Challenge A $400M in sales revenue, multi-division industrial products manufacturer was experiencing major issues in its Asia and China supply chain. Poor On-Time-Delivery and high logistics costs were forcing the company to absorb substantial price increases, while struggling with poor quality shipments…. Read More

ACCELERATING ORGANIC GROWTH VIA LEAN NEW PRODUCT DEVELOPMENT EXECUTIVE OVERVIEW: The Problem: One company with five major brands and no strong history of cooperation across divisions was falling behind in developing innovative new products. The Project: Two of TriVista’s top new-product development experts guided cross-functional teams to remake the way Maxcess listened to customers, evaluated new ideas, and… Read More

The Challenge: A $1B Private Equity fund was interested in acquiring a $300M manufacturer of cosmetic displays and retained the services of TriVista to conduct a standard Quality of Operations™ Due Diligence. Our Approach To thoroughly understand the target company’s business and operations, TriVista engaged in the following activities: Conducted an operational & capacity review… Read More

The Challenge A $120M food processing and conveyance equipment manufacturer engaged TriVista to conduct a sell-side Quality of Operations™ Due Diligence assessment with a focus on the company’s global operations Our Approach In addition to assessing the company’s product development processes, the TriVista team reviewed human capital requirements, manufacturing efficiencies, inventory management and footprint requirements…. Read More

The Challenge A $1B Private Equity Group was considering the possible divestiture of a $200M converting equipment manufacturer. The private equity firm hired TriVista to conduct a sell-side Quality of Operations™ Due Diligence with a focus on evaluating and opining on current operational processes and protocols, assessment of identified continuous improvement initiatives, and identification of… Read More

The Challenge A $1B North American manufacturer of automotive and related products company needed to increase its capacity of next generation operational leaders to accommodate rapid growth. Our Approach The TriVista Consulting and Recruitment teams collaborated to place Interim Plant Managers at key production sites while conducting simultaneous searches for positions located in the states… Read More

The Challenge A private equity-owned provider of power conversion, battery charging, and battery products needed to add a Director of Procurement to an energetic management team engaged in integrating several businesses. Our Approach The TriVista Recruitment team hosted an in-depth kick-off meeting to gain a thorough understanding of the role’s requirements and the firm’s overall… Read More

The Challenge A $700M Private Equity fund was interested in acquiring a $100M industrial components manufacturer with a U.S. and Greater China footprint. TriVista was retained to provide Quality of Operations™ Due Diligence support to assess the business’ supply chain operations and determine potential savings. Our Approach Mobilize multiple project teams in several regions to… Read More

The Challenge A $500M manufacturer of windows, doors, insulated glass products was seeking expert operations consulting expertise to assist them in transforming their production operations. The company sought to deploy Lean Six Sigma and other manufacturing best practices across 3 sites in North America. TriVista was retained to help jump start their lean journey. Our… Read More

The Challenge A private equity-backed manufacturer and supplier of automotive brake components sought to relocate several US production facilities to Mexico to combat rising labor costs and address their growing customer base in Central America. TriVista was retained to provide factory relocation and consolidation consulting expertise, helping the company conduct a detailed study to determine… Read More

The Challenge A private equity firm retained TriVista to conduct a compressive Quality of Operations™ due diligence analysis on a $300M publicly traded automotive aftermarket distribution company. Our Approach Reviewed the company’s largest distribution center for operations improvements Interviewed senior management and supply chain leaders Conducted a DC capacity review to understand future requirements Analyzed… Read More

The Challenge A $750M global manufacturer of highly specialized, aerospace parts was seeking assistant in determining a consolidation strategy for their underutilized plant in the Midwest. TriVista was retained to provide operations consulting expertise and assistance in modeling and planning the consolidation effort. Our Approach Conducted a rapid three-week assessment of the underutilized facility to… Read More

The Challenge An industry leading aircraft interiors manufacturer backed by an $8.5B global private equity firm, was looking to acquire an OEM supplier of in-cabin components and thermal insulation products. TriVista was retained as an operational consultant to conduct a Quality of Operations™ assessment with the goal of assessing the target acquisition and identifying consolidation… Read More