The Challenge A large racking manufacturer required a current state production roadmap and longer-term facility strategy to meet a significant growth opportunity. The company had multiple facilities spread across a medium sized market creating significant transportation and labors costs while creating production bottlenecks. The leadership team needed a thought partner to assist in understanding the… Read More

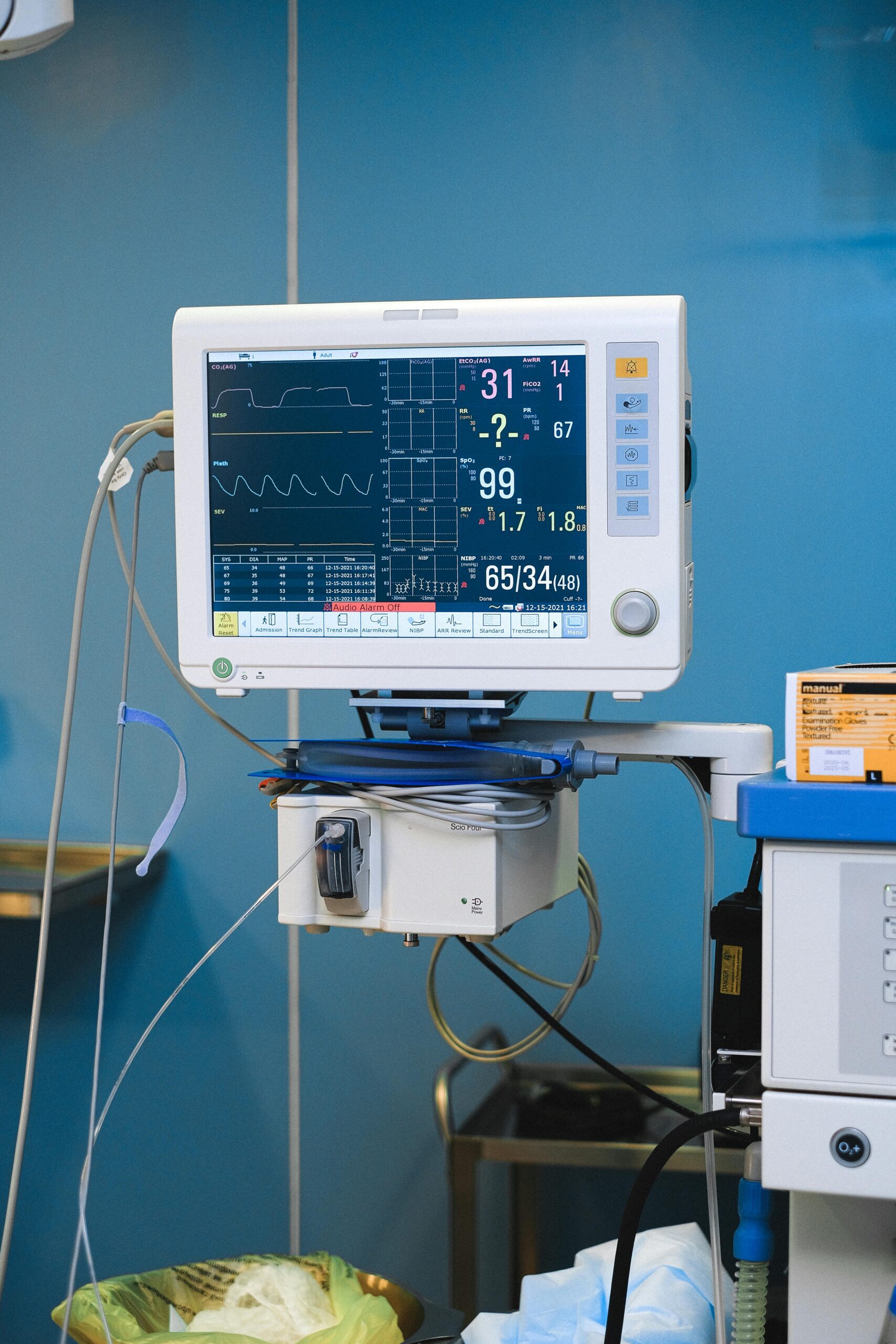

The Challenge A leading designer and manufacturer of medical equipment recently acquired a competitor and wanted to consolidate the manufacturing sites. They chose the acquired company’s site as the final location. The company needed help to move its existing production facility. The company brought TriVista on to help consolidate the manufacturing sites. Our Approach Analyzed… Read More

The Challenge A client engaged TriVista to provide acquisition integration support relating to the integration of two leading medical device manufacturers. The scope of the integration included all SG&A, Operations, and IT including ERP harmonization. Our Approach Our team of experts broke down the engagement with the following approach: Conducted multiple site visits with key… Read More

A fast-growing producer and distributor of ethnic food. The Challenge TriVista was hired to conduct a Quality of Operations™, Food Safety, and IT Due Diligence assessment on a producer and distributor of dry packed food goods. Our Approach TriVista conducted a due diligence assessment of key business value streams and associated IT support systems with… Read More

A packaging component manufacturer. The Challenge TriVista was engaged by a private equity firm to perform a Quality of Operations™ Due Diligence assessment on a packaging component manufacturer that was being considered for acquisition. The scope of the analysis included identifying potential acquisition synergies and developing integration strategies for the target company and the portfolio… Read More

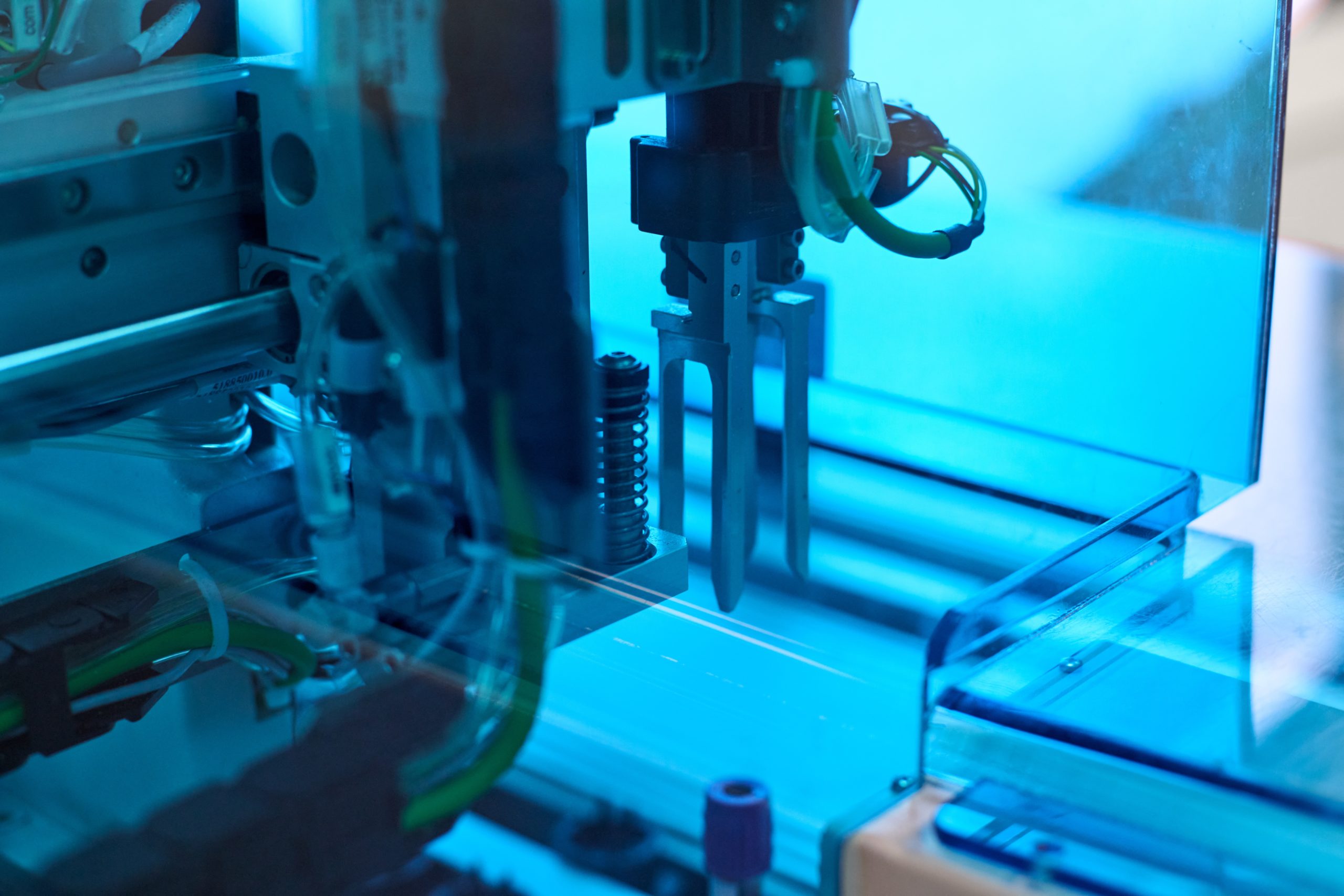

A manufacturer of machinery and equipment. The Challenge A private equity firm was looking to acquire a leading manufacturer and importer of machinery and equipment. They brought in TriVista to conduct both an operations and IT due diligence to help identify operational and IT levers that would continue to expand EBITDA and/or reduce current operational… Read More

A landscaping company. The Challenge TriVista was retained by private equity investors and the leadership team of a landscaping business to provide Quality of Operations™, Information Technology Due Diligence, and cost synergy analysis relating to the possible add-on acquisition of another landscaping company. Our Approach Through site visits with the target company, interviews with the… Read More

A seasonings manufacturer with sites in the U.S. and Mexico. The Challenge A private equity client was considering acquiring a food manufacturer of seasonings that use fresh ingredients. The target operates facilities in the U.S. and Mexico. The facilities have undergone recent changes in management and are experiencing market growth as well as implementing operational… Read More

A producer of food products that focus on healthy fats and plant-based proteins. The Challenge A private equity firm was evaluating the acquisition of producer of food products that focus on healthy fats and plant-based proteins. The firm brought us in to evaluate overall operations strategy, quality and food safety, co-manufacturer production operations, SIOP, and… Read More

The Challenge TriVista was engaged by a private equity firm to conduct a Quality of Operations™ (QOO™) due diligence and technology rapid assessment on a leading automotive performance aftermarket company with revenues of $325M. The target company operates with 5 primary distribution centers throughout North America and 1 small manufacturing facility servicing customers in vehicle… Read More

The Challenge TriVista was hired by a private equity firm to conduct a Quality of Operations™ and Technology Due Diligence assessment on a leading professional services consulting firm. The target company is a platform investment opportunity that the private equity firm plans to support with the continued growth of the business through both organic and… Read More

The Challenge A private equity backed, leading service provider who installs and repairs home / business security products retained TriVista to provide a Quality of Operations™ due diligence relating to the possible beach-head, add-on acquisition with multiple locations for its platform business. Our Approach Through a site visit of the target company, management calls, and… Read More

A private equity firm evaluating an investment in an $80M ready-to-assemble home furniture manufacturer

A $1B private equity owned automotive aftermarket re-manufacturer was seeking to acquire a $140M bolt-on.

A Private equity firm looking to acquire a $15M revenue medical device company retained TriVista to perform a Quality of Operations due diligence

A Private Equity-backed specialty coatings company was seeking to acquire a sizeable competitor with complementary adjacencies hired TriVIsta to conduct a pre-acquisition Quality of Operations® Due Diligence assessment to model the options, costs, savings and resources required to integrate the businesses, as well as develop a detailed integration plan

A Private Equity firm retained TriVista to conduct a pre-acquisition Quality of Operations® Due Diligence on a $57M manufacturer and supplier of specialty car care chemical products

The Challenge A $700 Million Private Equity fund was interested in acquiring a $100 Million industrial components manufacturer with a presence in the U.S. and China. Given their limited experience in cross-border deals, the firm retained TriVista to conduct a detailed Operational Due Diligence in both countries. The Approach TriVista mobilized project teams in China… Read More

The Challenge: A $1B Private Equity fund was interested in acquiring a $300M manufacturer of cosmetic displays and retained the services of TriVista to conduct a standard Quality of Operations™ Due Diligence. Our Approach To thoroughly understand the target company’s business and operations, TriVista engaged in the following activities: Conducted an operational & capacity review… Read More

The Challenge A packaging company was in the process of acquiring a competitor. There was significant synergy opportunity across the combined 11 production sites. TriVista was brought on to complete a Quality of Operations™ Due Diligence Assessment, as well as complete a detailed synergy analysis that clearly calculated the practicality and upside associated with the… Read More

The Challenge A $700M Private Equity fund was interested in acquiring a $100M industrial components manufacturer with a U.S. and Greater China footprint. TriVista was retained to provide Quality of Operations™ Due Diligence support to assess the business’ supply chain operations and determine potential savings. Our Approach Mobilize multiple project teams in several regions to… Read More

The Challenge A private equity firm looking to acquire a confectionary business retained TriVista to perform a Quality of Operations™ Due Diligence assessment, as well as a Food Safety Due Diligence workstream. Our Approach Conducted a site visit at U.S. headquarters Assessed effectiveness of food safety / regulatory programs, Sales, Inventory, Operations Planning (SIOP), and… Read More

The Challenge A $400M Private Equity firm looking to acquire a distributor of premium bathroom accessories retained TriVista to provide Quality of Operations® Due Diligence support. Our Approach Conducted facility visits in China and the U.S. Interviewed management teams in both countries Led a detailed review of procurement and sourcing operations Evaluated warehousing, distribution and… Read More

The Challenge A middle market Private Equity firm seeking to acquire a $500M manufacturer and distributor of specialty apparel products sold into various B2B and Consumer end markets. TriVista was retained to provide Quality of Operations™ Due Diligence consulting support to qualify and quantify EBITDA and working capital improvement opportunities that existed in the business…. Read More

The Challenge A global, mid-market Private Equity firm seeking to acquire a five-year old start-up consumer products company that specializes in infant and toddler soft goods, retained TriVista to provide Quality of Operations™ Due Diligence with a strong focus on supply chain due diligence. The company was growing exponentially, and was on track to grow… Read More

The Challenge A private equity firm was looking to acquire an OEM supplier of bathroom accessories for residential and commercial construction and remodeling markets. TriVista was retained to provide Quality of Operations™ Due Diligence support to assess the business, and understand EBITDA and working capital improvements in the business to enhance enterprise value. Our Approach… Read More

The Challenge A private equity firm retained TriVista to conduct a compressive Quality of Operations™ due diligence analysis on a $300M publicly traded automotive aftermarket distribution company. Our Approach Reviewed the company’s largest distribution center for operations improvements Interviewed senior management and supply chain leaders Conducted a DC capacity review to understand future requirements Analyzed… Read More

The Challenge An industry leading aircraft interiors manufacturer backed by an $8.5B global private equity firm, was looking to acquire an OEM supplier of in-cabin components and thermal insulation products. TriVista was retained as an operational consultant to conduct a Quality of Operations™ assessment with the goal of assessing the target acquisition and identifying consolidation… Read More