A $1B private equity owned automotive aftermarket re-manufacturer was seeking to acquire a $140M bolt-on.

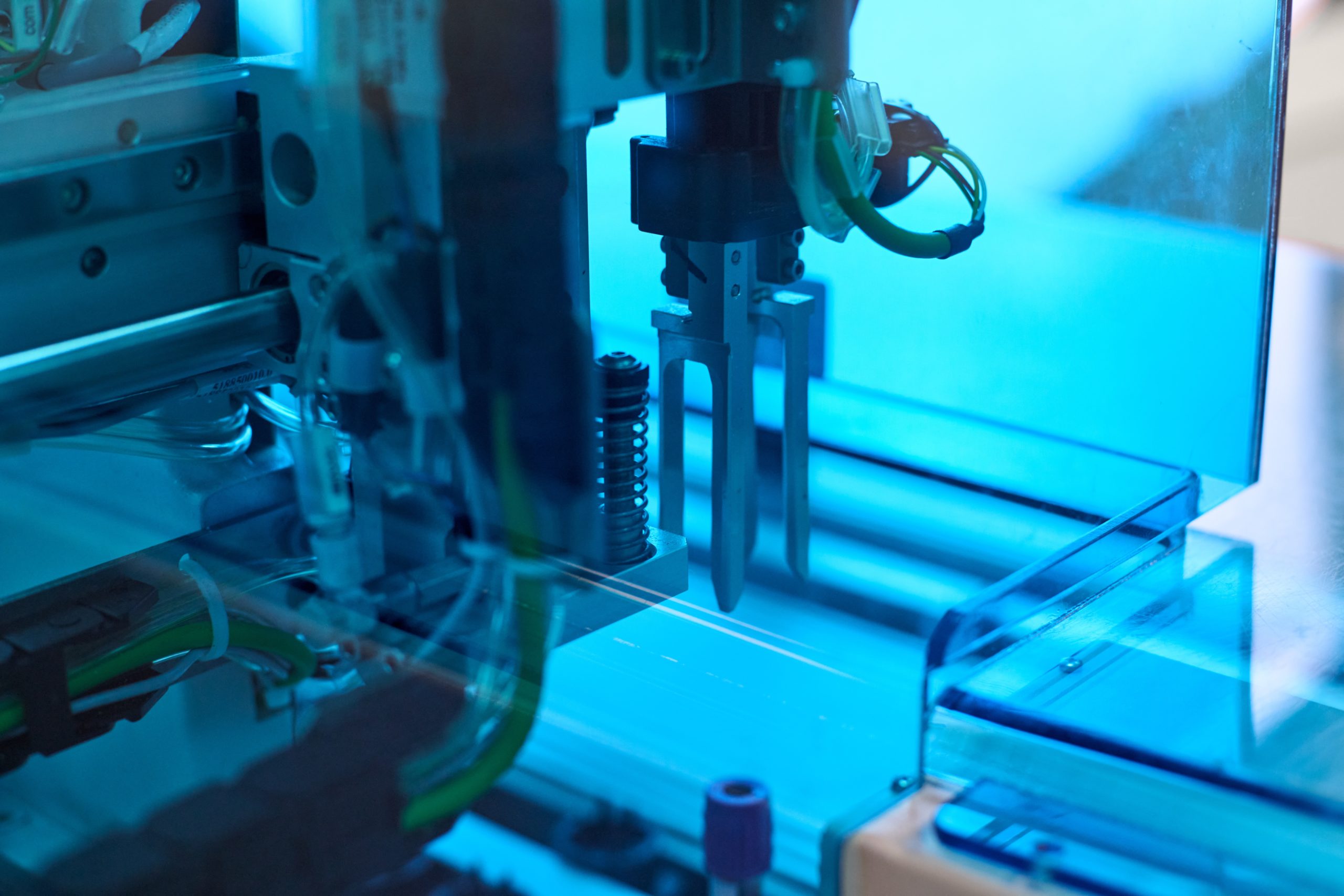

A Private equity firm looking to acquire a $15M revenue medical device company retained TriVista to perform a Quality of Operations due diligence

A Private Equity-backed specialty coatings company was seeking to acquire a sizeable competitor with complementary adjacencies hired TriVIsta to conduct a pre-acquisition Quality of Operations® Due Diligence assessment to model the options, costs, savings and resources required to integrate the businesses, as well as develop a detailed integration plan

A Private Equity firm retained TriVista to conduct a pre-acquisition Quality of Operations® Due Diligence on a $57M manufacturer and supplier of specialty car care chemical products

The Challenge A $700 Million Private Equity fund was interested in acquiring a $100 Million industrial components manufacturer with a presence in the U.S. and China. Given their limited experience in cross-border deals, the firm retained TriVista to conduct a detailed Operational Due Diligence in both countries. The Approach TriVista mobilized project teams in China… Read More

The Challenge: A $1B Private Equity fund was interested in acquiring a $300M manufacturer of cosmetic displays and retained the services of TriVista to conduct a standard Quality of Operations™ Due Diligence. Our Approach To thoroughly understand the target company’s business and operations, TriVista engaged in the following activities: Conducted an operational & capacity review… Read More

The Challenge A packaging company was in the process of acquiring a competitor. There was significant synergy opportunity across the combined 11 production sites. TriVista was brought on to complete a Quality of Operations™ Due Diligence Assessment, as well as complete a detailed synergy analysis that clearly calculated the practicality and upside associated with the… Read More

The Challenge A $700M Private Equity fund was interested in acquiring a $100M industrial components manufacturer with a U.S. and Greater China footprint. TriVista was retained to provide Quality of Operations™ Due Diligence support to assess the business’ supply chain operations and determine potential savings. Our Approach Mobilize multiple project teams in several regions to… Read More

The Challenge A private equity firm looking to acquire a confectionary business retained TriVista to perform a Quality of Operations™ Due Diligence assessment, as well as a Food Safety Due Diligence workstream. Our Approach Conducted a site visit at U.S. headquarters Assessed effectiveness of food safety / regulatory programs, Sales, Inventory, Operations Planning (SIOP), and… Read More

The Challenge A $400M Private Equity firm looking to acquire a distributor of premium bathroom accessories retained TriVista to provide Quality of Operations® Due Diligence support. Our Approach Conducted facility visits in China and the U.S. Interviewed management teams in both countries Led a detailed review of procurement and sourcing operations Evaluated warehousing, distribution and… Read More